Transfer pricing transactions documentation

New rules came into effect from 1 January 2019

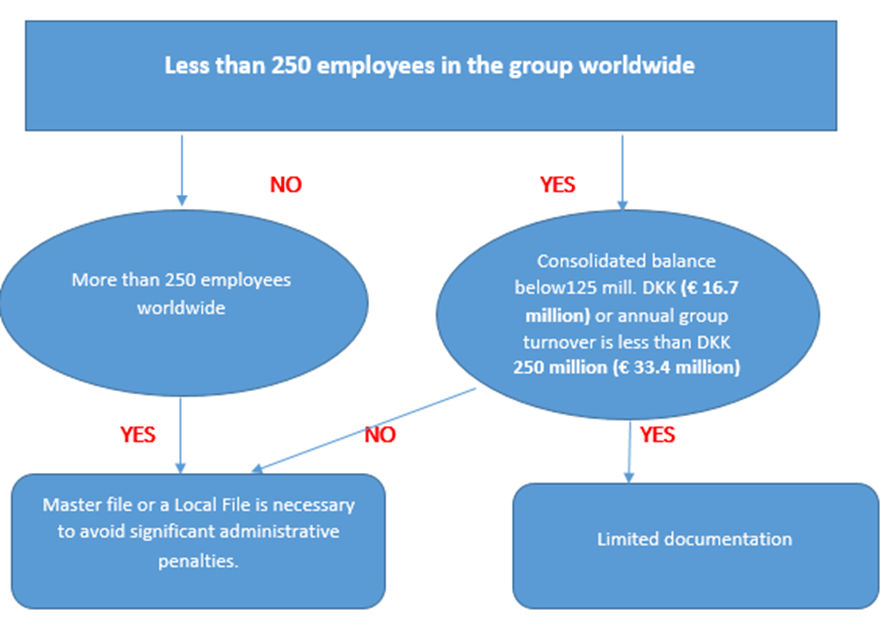

A proper documentation of the intercompany transactions by means of preparing either a Master file or a Local File is necessary to avoid significant administrative penalties.

New legislation

The content of the proposed legislative changes was originally made in the autumn of 2019, as with intended effect for income years beginning 1/1 2020. Now L 28 has been made and adopted 3/12 2020, and the most significant change is the entry into force which is 1 year later.

Companies with the calendar year 2021 as income year

The change in the law means that the TP documentation must in future be submitted as part of the information form, but with an additional 60-day deadline.

Companies with calendar year, accounts must submit TP documentation for the income year 2021 no later than 60 days after the deadline for information form 2021 (30 June 2022), i.e. 30 August 2022.

Companies with a deferred income year 2021, income years beginning on 2 April 2020 and onwards, are only covered by the bill from income year 2022, which has been changed in relation to the original bill.

The Authorities are given opportunities for estimations of taxable income if documentation is not prepared in a timely manner.

Not timely prepared documentation gives fines in it selves.

Penalties

The fines seen are in the range of DKK 125,000 (16.700 €) per year the company do not have the proper documentation, and it is normal that the Tax Authorities will look for the last 5 years.

Some more details and explanations for Transfer Pricing in Denmark

The Danish Tax Authorities have recently started intense audit activities reviewing the Danish Group’s transfer pricing policies, assessing whether the companies comply with the TP documentation requirements.

It is our impression that the tax authorities have so far focused on very large companies in Denmark, but we have now learned that the Authorities are increasingly focusing on both medium-sized and small businesses. We have already seen the first queries in this segment.

The Transfer Pricing Framework

For large MNE groups, the Final BEPS report on Transfer Pricing (in particular, with Sections 8,9, 10 and 13) has caused changes to the OECD Transfer Pricing Guidelines, which are the international recommendations followed By the Danish tax administration to apply transfer pricing rules.

In particular, the new rules implement a three-tier documentation focusing in proving an alignment between the contractual arrangement in place between the associated enterprises and their underling actual conduct. In particular, the new system with general documentation for the group (Master File) and a country-specific documentation (Local File), on top of a Country-by Country reporting Template for large Danish groups with a turnover exceeding 750 mills €.

For non-compliance with the documentation rules significant administrative penalties are imposed. The fines we have seen are in the range of DKK 125,000 (16.700 €) per year the company do not have the proper documentation. The latest inquires we have seen here in 2019 is for the years 2013-2017. It is a fixed amount of DKK 250,000, but can be reduced to DKK 125,000 if later documentation of the required quality appears.

What Authorities can demand for the Danish company is either a Master file (if the parent company is headquarter in Denmark) or a local file describing in detail the intercompany transactions and the transfer pricing method selected based on a selected comparability analysis.

However, this file cannot stand alone, but often must refer to a Masterfile describing the general circumstances and the value drivers (e.g. tangible or intangible assets) for the group.

If not, this information must appear on the local file to have a full overview

Once the Tax Authorities require the proper documentation, the company have 30 days to answer some questions and 60 days to submit the full TP documentation and not more. In these situations, one can conclude that it is very difficult to provide sufficient documentation for yeas already passed.

New legislation

New law that applies to 2021 accounts means that the documentation, always 60 days after the deadline for the information form, must be submitted and that the authorities have the opportunity to estimate the taxable income if the documentation is not prepared in time.

Non-timely documentation provides fines.

Since transfer-pricing provisions are, – except for the amount of penalties applicable -, aligned within in the EU, we can start by asking if you have documentation for the entire group and whether you believe that the local descriptions of your intercompany transactions (as described in the local File) can meet the requirements.

To give an impression of what is required, we have translated part of the Danish Provisions regarding the Master File and Local File, shown here below.

The documentation must be completed and updated simultaneously with the submission of the Tax Return.

Assistance needed?

Need assistance with Transfer Pricing documentation, contact Kurt Bülow direct phone +45 57662462 mail kurt.bulow@ecovis.dk or write to Bo.langtoft@ecovis.dk or denmark@ecovis.com

Contents of a Masterfile and Country Specific File (Local File)

Masterfile (rules from January 1st 2019)

- The master file documentation must contain a group chart showing the legal and organizational structure of the Group, including the countries where the individual parties are involved.

- The documentation shall contain a general description of the Group’s business activities, including the following:

- The most important value-added factors (drivers of business profit) in the Group.

- A description of the Group’s supply chain for the five largest products and / or services relating to sales and all products and / or services representing more than five percent of the Group’s consolidated turnover. A diagram can illustrate the description.

- A list of the essential service agreements between the related parties in the Group, with the exception of research and development services agreements, as well as a description of the significant services that the Group’s main service centres maintain or can handle and the transfer pricing policies applied for allocation of service costs and determination of settlement prices for intra-group services.

- A description of the largest geographic markets for sales of products and services, cf. No. 2.

- A brief functional analysis, which describes the primary contributions to the Group’s overall value creation with information about which of the Group’s associated parties contributes in relation to significant functions, risks and assets.

- A description of significant restructuring, acquisitions and divestments occurred in the course of the income year.

- The documentation for the Group’s intangible assets (as defined in Chapter VI of the OECD Transfer Pricing Guidelines) shall contain the following:

- A general description of the Group’s overall strategy for the development, ownership and utilization of intangible assets, including geographical location of the Group’s primary research and development facilities, as well as the indication of which activities are conducted.

- A list of intangible assets or groups of intangible assets in the Group that affect transactions between related parties and indicating which entities in the Group are legal owners of these intangible assets.

- A list of significant agreements between the related parties regarding intangible assets, including primary cost-sharing arrangements (CCA), research and development service agreements, and licensing and royalties agreements.

- A general description of the Group’s overall transfer pricing policies in relation to research and development activities and intangible assets.

- A general description of all significant transfers of rights to intangible assets between the related parties in the income statement, specifying the entities and countries involved in the transfer, and the related payments.

- The Master file documentation relating to the financial activities of the group shall contain the following:

- A general description of how the Group, including a description of the most central financial arrangements with independent borrowers is funded.

- Identification of all related parties that have a central financing function in relation to the Group, including indication of the countries under whose legislation these entities are organized and the location from which the units are managed.

- A general description of the Group’s transfer pricing policies in relation to the financial arrangements between the related parties.

- The documentation relating to the Group’s accounting and tax position shall contain the following:

- Consolidated financial statements for the year if this is prepared for accounting purposes, internal management, and taxation or otherwise.

- A list and brief description of the Group’s existing Unilateral APAs (Advanced Pricing Agreement), tax agreements and

– Progressive effects on the distribution of income between countries.

This document is an unofficial translation of a part the original Danish text from Ministerial Order No. 1297 of 31/10/2018 Applicable, Publication date: 22-11-2018,The Ministry of Taxation. In the event of disputes or misunderstandings arising from the interpretation of the translation, the Danish language version shall prevail.

2.10 2019The country-specific file (rules from January 1st 2019)

- The country-specific documentation relating to the taxpayer must contain the following:

- A description of the taxpayer’s management structure, a local organization chart and a description of the individuals to which the local management reports, as well as the indication in which countries these individuals have their usual office addresses.

- A detailed description of the company and the business strategy of the taxpayer, as well as the indication of whether the taxpayer has been involved in or caused by restructuring or transfers of intangible assets in the income and income immediately prior to related income, and an explanation of how such transactions have or have had an effect on the taxpayer.

- Indication of the taxpayer’s most important competitors.

- In the country-specific documentation, the following information for each category of controlled transactions to which the taxpayer is involved shall be provided:

- A description of the transactions checked (e.g., purchase, production, sale, delivery or receipt of services, loans, guarantees, purchases and sales of intangible assets, royalties, etc.) and a description of the context in which they controlled transactions have taken place.

- Estimated total internal payments for each category of controlled transactions in which the taxpayer is included (e.g. payments for products, services, royalties, interest, etc.), specified on the tax jurisdictions to which and from which payments have taken place.

- Identification of each of the related parties involved in each category of controlled transactions with the taxpayer and a brief description of the relationship with each of these parties.

- Copy of all significant controlled agreements with which the taxpayer is included.

- A detailed comparability analysis and functional analysis of the taxpayer and the relevant related parties in relation to each category of controlled transactions, including a description of all changes compared to the previous year.

- Indication of the most appropriate transfer pricing method in relation to each category of transactions and justification for the choice of method.

- When it is relevant to the transfer pricing method, it must be stated which of the parties to the transaction is selected as the tested party, and the choice must be justified.

- A description of the assumptions and assumptions used by the transfer pricing method.

- If a multiple analysis has been made, this approach should be justified.

- A list and description of the selected comparable transactions (internal and external) and information on the financial indicators of the independent companies used in the transfer pricing analysis, including a description of the exposure process and the source of it used information.

- An explanation of any comparability adjustments and whether adjustments have been made to the results of the tested party, the comparable transactions or both.

- An explanation of why it can be concluded that the relevant transactions are priced in accordance with the imposition principle using the chosen transfer pricing method.

- An overview of the financial data or accounting data used in the use of the transfer pricing method.

- A copy of existing unilateral, bilateral and multilateral APAs, as well as other tax treaties and futures with which the taxpayer is not a party, but which is relevant to the transactions verified.

- The following material relating to the financial, financial, and accounting data in the country-specific documentation must be attached:

- If there is an audited financial statement for the taxpayer for the income year, this must be enclosed and, if not, any available unaudited accounts must be included instead.

- Data and allocation schedules showing how the accounting data used in the transfer pricing method can be reconciled with the financial statements of the taxpayer.

- Overview and Schedules showing the relevant economic, financial, or accounting data for the comparable independent transactions used in the transfer pricing analysis, as well as the source of such data.

This document is an unofficial translation of a part the original Danish text from Ministerial Order No. 1297 of 31/10/2018 Applicable, Publication date: 22-11-2018,The Ministry of Taxation. In the event of disputes or misunderstandings arising from the interpretation of the translation, the Danish language version shall prevail.

2.10 2019Limited documentation

The documentation that a smaller company will have to prepare under the more lenient rules must – like other documentation prepared under section 39 – be such that it can form the basis for an assessment of whether prices and terms are set in accordance with , what could have been achieved if the transactions had been completed by independent parties.

Full documentation for smaller companies will the only be the following situations:

Taxpayers who, alone or together with group affiliated companies, cf. 2, has less than 250 employees and either has an annual total balance of less than DKK 125 million. (16.700 €) or an annual turnover of less than DKK 250 million. DKK must only prepare and keep written documentation of how prices and terms are set for

- controlled transactions with natural and legal persons domiciled in a foreign state which does not have a double taxation agreement with Denmark and who is not a member of the EU or the EEA,

- controlled transactions with a permanent establishment located in a foreign state which does not have a double taxation agreement with Denmark and which is not a member of the EU or the EEA, and

- Controlled transactions with a permanent establishment located in Denmark, provided that the taxpayer, cf. section 37 (6) (e), is a resident of a foreign state which does not have a double taxation agreement with Denmark, and which is not Member of the EU or EEA.

21/1 2021

Contact us:

Kurt Bülow

State Authorised Public Accountant, Partner

+45 5766 2462

Bo Langtoft

State Authorised Public Accountant, Partner

+45 5766 2463

Disclaimer

The information contained in this site/document is for general guidance on matters of interest only for the personal use of the reader. The impact of laws can vary widely based on the facts involved. Given the changing nature of laws, rules and regulations, and the inherent hazards of electronic communication, there may be delays, omissions or inaccuracies in information contained in this site/document. Accordingly, the information on this site/document is provided with the understanding that the Web site / document in it selves are not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. Before making any decision or taking any action, you should consult an Ecovis professional.

While we have made every attempt to ensure that the information contained in this site has been obtained from reliable sources, Ecovis is not responsible for any errors or omissions, or for the results obtained from the use of this information.