Shareholder Deadlock – What to do in your Chinese joint venture

The entrepreneurial journey often begins as a harmonious duet, where dreams are shared and ambitions align. Establishing a company seems straightforward, especially when there are only a few partners in the mix. China as the second-largest economy in the world, it has always been an attractive market to start a joint venture. However, as the saying goes, „With great opportunity comes great responsibility,“ and this responsibility often extends to the delicate art of managing shareholder relationships.

Occasionally, the entrepreneurial symphony can hit a sour note, leaving shareholders at a standstill, unable to harmonize on pivotal business decisions. This applies especially to 50-50-ratio joint ventures, in which shareholders cause a deadlock situation – the legal term for a gridlock; two parties cannot reach a decision as they are stuck on their own viewpoint. Especially when more unbalanced equity ratios come into play, problems will arise more often.

In the following pages, we will delve deep into this topic, examining the common causes of shareholder deadlock, dissecting the legal factors that come into play, and, most importantly, providing you with practical strategies and insights to help you steer your Chinese joint venture towards success.

What are the most common reasons for a shareholder deadlock?

- Unbalanced or set equity share: Unbalanced ratios are also critical if the difference between majority and minority shareholders is too big, such as 45:45:10. The 10 % shareholder essentially has no real influence on decision-making and can be easily ignored by majority shareholders. Important matters and decisions require more than 2/3 of the voting rights in order to come into force, according to Chinese Company Law. An uneven number of shareholders in a company or a set equity share with a rate of 50:50 will be critical. 65:35 is also not recommended as they are not able to reach a consensus here as well.

- Difference in contribution to company and average equity share: Dividing the equity averagely among the shareholders is another idea, yet might be an ineffective method, with every shareholder contributing a different amount of money into the company, meaning individual shares won’t be equal to what the individual shareholder actually has invested – making dissatisfaction inevitable. In family-owned or small businesses, employees or directors are often shareholders as well. What if a member does not pull the weight in the view of the other shareholders?

Additionally different viewpoints on the business strategy or withholding information from shareholders can be a critical point too: The business roadmap – shareholders’ agreement

A fundamental element that can be particularly helpful in such situations is the shareholder´s agreement. Depending on the business, this agreement either has specific terms regarding shareholder disputes or it contains “off-the-shelf” clauses.

Either way, these sentences/(clauses) are essential if disputes are already gaining speed or are non-preventable anymore. Conflict resolution can be very costly if there is no corresponding shareholder agreement at hand.

A good shareholders’ agreement will therefore obtain a deadlock clause. Professional help for a well-formulated and compliant agreement is recommended here. Involving your mandatory supervisor in your Chinese company will be a great idea. You are looking for one? Klick here to inform yourself on how to find the perfect supervisor.

Still, the “horse has left the barn” – what now?

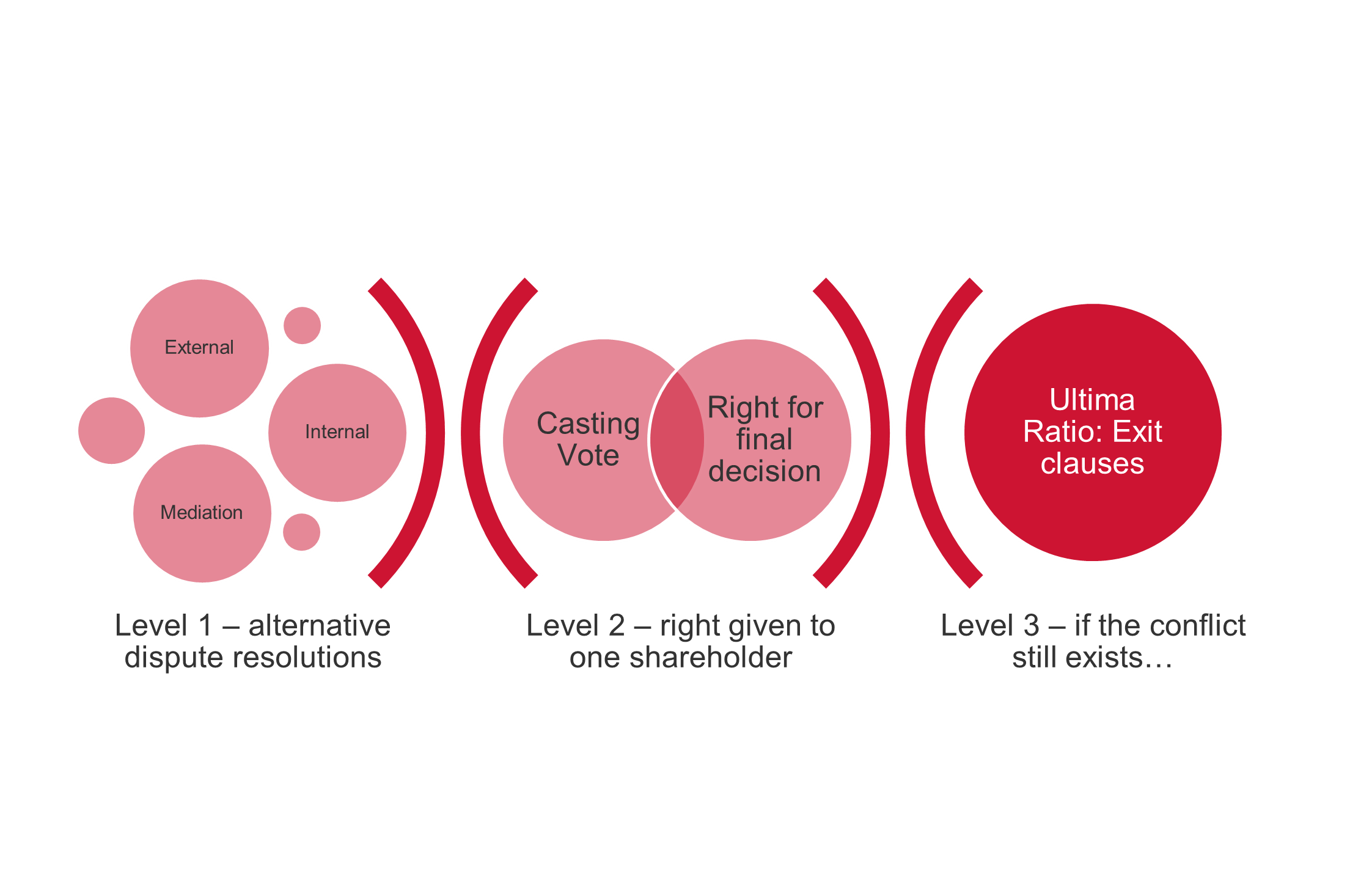

We recommend a structured and 3 levelled system to handle these challenging situations. First level conflict resolution uses internal and external resolution mechanisms. If this does not work out, we would move to level two. Giving the involved shareholders the right to decide the final decision. In case problems are still not solved, someone needs to exit the company; level three exit clause.

„Start by resolving internal issues first, involving management and shareholders. For major decisions, delegate authority upwards if possible. Joint Ventures can seek help from parent companies and involving higher-level management increases conflict resolution willingness.“

Why? The moment when upper level gets involved, both (fighting) shareholders admit that they do not harmonize.

Instead of solving the situation within the own company, one could also search for an external conflict settlement procedure (mediation or arbitration). The mediator does not make decisions, he will convey messages between shareholders and try to lead a way outside the fog. The actual problem solving relies on the shareholders themselves. Yet, it comes with risks like binding verdicts without higher instances, especially in smaller cities where neutrality may be uncertain.

Last way out: exit clauses

Worst-case scenario: ongoing shareholder dispute with no resolution. In Germany, Anglo-American contract law methods are now used regularly to resolve and prevent deadlocks. They allow for a rapid exit when one shareholder’s shares are acquired by another. Here’s an overview of the two main methods:

Russian roulette clause (also called “Chinese clause”)

Goal: Resolve a shareholder conflict in two-people-companies through exit of one shareholder.

Main idea:

Each shareholder has the right to propose selling their shares to the other shareholders at an established and official price, denoted as X. We will refer to the shareholder wishing to sell as „Seller A“. In the event that Seller A extends this offer to the other shareholder, known as „Shareholder B“, Shareholder B now faces two options (simplified version):

- As the first option Shareholder B can choose to accept the offer and purchase the shares from Seller A at the specified price X. This transaction results in Shareholder B becoming the sole owner of the shares.

- Alternatively, Shareholder B can opt to sell their own shares at the same fixed price X, as determined by Seller A, to co-shareholders.

Commentary: This clause expedites a deadlock resolution, meaning the remaining shareholder can continue doing business. But this also leads to a risk for rapid loss of shareholder status! The price offered by Seller A should be reasonable in the ideal case. However, financially stronger shareholders have a clear advantage, enabling them to manipulation. In addition to that it can be purely coincidental, which shareholder makes an offer first.

Texas Shootout

Goal: sealed bidding for other shareholder’s shares suggested by each shareholder. Either the first offer is accepted, or a higher counteroffer occurs. The highest bid is required to buy the other out.

Commentary: this approach – evolving from the Russian-Roulette-Clause – resolves the deadlock swiftly. However, each participant must be financially equal in order to maintain a fair bidding.

Moreover, this tactic may be abused by a shareholder attempting to pressure other shareholders into selling their shares. Say for example shareholder A knows of shareholder B’s liquidity difficulties. By forcing a deadlock (especially in two-person-constellations), A is able to force B’s hand into selling his shares at a lower price.

Remember: a shootout can be a final resort, should, however, not be put in to place for every differ in opinion!

Our experience

During open processes like mediation, granting ultimate decision-making authority to one shareholder can be challenging. It should ideally be assigned based on expertise, but egoism and disputes can arise. Periodic rotation of this authority can help prevent abuse.

We suggest that while arbitration is often recommended, it just really depends on the case. Caution is advised, as it may not always be the best fit. Without arbitration clauses in contracts, state court becomes mandatory, requiring advance decision-making for dispute resolution.

In our experience, when there is no Shareholder Agreement in effect or the existing Shareholder Agreement lacks adequate provisions for addressing deadlock situations, shareholders may resort to legal actions. This may entail one party seeking relief from what they deem as oppressive behavior, making claims of directorial breaches of duty, or petitioning for the company’s winding-up on just and equitable grounds. Engaging in such legal proceedings can be remarkably costly and time-intensive, with the potential to significantly impact the company’s business and financial stability. Hence, it serves the best interests of all parties involved to establish a written Shareholder Agreement that outlines precise procedures for resolving deadlock scenarios in the first place.

We as experienced experts can help you with your decision!

In conclusion, shareholder deadlock is a formidable challenge that every business should be prepared to face. Our journey through the complexities and resolutions of this issue has revealed that, while the path may be fraught with obstacles, it is not insurmountable. Our law firms, Ecovis Ruide in Shanghai and Ecovis Heidelberg, specialize in supporting German and Chinese companies, both from a tax and legal perspective. Feel free to get in touch with us to assist you in preparing a well-drafted Shareholder Agreement and establishing effective communication strategies that can help prevent or minimize losses in the event of a shareholder deadlock. Through years of experience and specific knowledge of the German, international, and Chinese business environment, Richard Hoffmann has successfully supported several hundred companies to navigate through the complexity of legal, tax and compliance issues in China. Contact us!