Chop management in your Chinese company – 2 case studies

Case Study I: I cannot visit my company in China. How do I manage my company chops?

Even though the long lockdown period is over and people are able to enter mainland China again, having certain precautions – in case one is suddenly not able to enter the country– is advantageous. The company chop (also known as seal or stamp) is essential to every business in China, as it is used to legally sign and authorize documents. So, how does this process work (or what is possible) if I am not able to enter country? Please find some answers and suggestion in our article below!

First of all, some basics about chops

The principle of using chops in China is almost 3000 years old. Evolving from drip-wax seals to the currently used stamp pad and chop; the importance and meaning is the same. Different to the Western manners, a signature in China is only an acknowledgement of intent to build a business relationship, but it is not legally binding until the document is sealed with a chop.

The company seal is seen as a substantial representative and can replace signatures as they are used in Western countries. It is important to note, that the company holds the rights and obligations, not the custodian of the company chop. The company’s person-in-charge is only the temporary holder.

Engraving the chop is the work of licensed chop-makers which are regulated by the local public security authority.

How can I obtain my chop?

In China, every registered company is permitted to receive its on engraved chop (when the registration at the PSB (Public Security Bureau) is finished). However, there are a couple of steps every FIE (foreign invested enterprise) needs to go through before obtaining its own chop. After the pre-registration of the company name with the SAIC (State Administration of Industry and Commerce) and receiving the agreement of the MOFCOM (Ministry of Foreign Commerce), the FIE has to define the Business Scope of the company. In the next step, the company has to hand registration documents such as the pre-registered company name, legal address, articles of association, amount of registered capital and the corporate organization chart. If everything was handed in successfully, the chops can be obtained.

The different types of chops

It is uncommon for companies to have a variety of different chops for various functions, even though is it not specified or restricted how many of them a company can utilize. Here a short introduction to the most important ones:

- Official company chop (公章) – mandatory – Symbolizes the company as a legal person. It carries the Chinese company name (sometimes with an English translation) and the registration number. After the company registration at the AIC (Administration of Industry and Commerce), the chop has to be registered at the PBS (Public Security Bureau). Usually, they are a circle shape. It is essential for any legal execution (or binding relationship or issuance of papers) by the company.

- Electronic company chop (电子公章) – not mandatory

- Legal representative’s name chop (法定代表人章) – mandatory – This one is required as signatures used for authorization. Thus, this chop also has the power to legally bind the company. Different than the company chop is the shape, this one is rectangular and showing the name of the legal company representative in Chinese characters.

- Finance chop (财务专用章) – mandatory – As the name states, this one is used to verify all kinds of documents related to communicating with banks (e. g. checks etc.).

- Invoice (fapiao) chop (发票专用章) – Used of invoices, this seal is compulsory for accounting and book-keeping. All formal invoices need this special stamp. The lettering contains the wordings: “special seal for invoice” next to the tax registration number.

- Contract chop (合同专用章) – It is not mandatory. If the enterprise has a contract chop, it needs to stamp on the contract. When signing a contract, this chop has the same authority as a company chop and is therefore often used by sales representatives.

- Other chops for special purposes are e. g. the customs chop, personal chop or human resource chop.

They do come with this advantage, that this system adds security in certain aspects: When stamping a contract, one chop must be placed across all pages. So it will be easily verifiable if some pages were substituted or are missing. Also, transferring legal authority to employees in case of emergencies or the absence of the legal representative is less problematic.

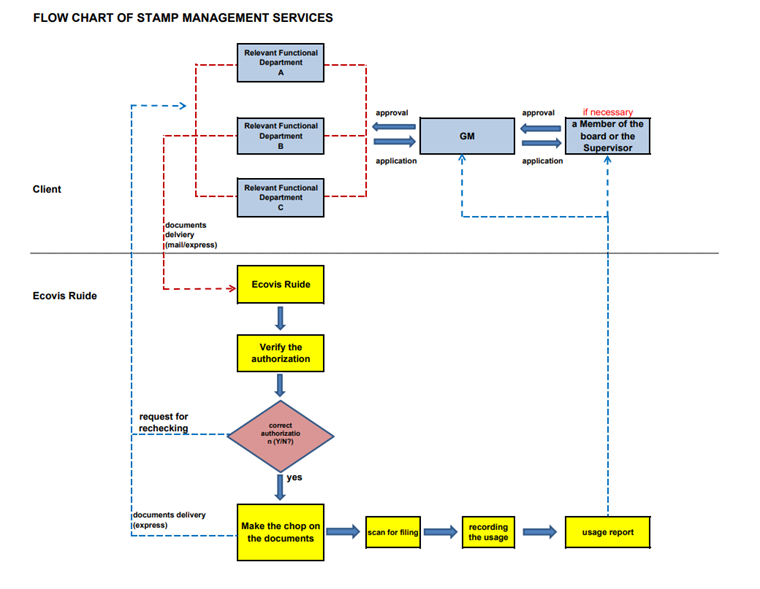

How does the stamp management services work?

Please have a look at the following diagram:

Safeguarding

Monitoring these chops should be done by internal controls. A single chop bears a huge amount of legal authority. The first step here would be to carefully decide to whom the chop will be administered to as sometimes possessing the chop provides proof of the authorities to use it. Here, we suggest some strategies to ensure that your seals are safe:

- Entrusted to the same person in the company (Not recommended); Assign at least 2 colleagues of the company to keep these seals separately to play a role of mutual supervision

- If your company has some special circumstances and cannot entrust a specific person to keep the official seal for management, then another option is to seek assistance from professional agency

- ECOVIS Ruide Shanghai can also provide such services in case of special circumstances in your enterprise, we can keep the chops under your authorization

Case Study II: I cannot be present at my company every day for a while. How can I manage the daily business transactions of the enterprise?

In addition to the above company seals, another important enterprise internal control management that we cannot ignore is bank payment management. This usually includes online banking keys; bank payment bills, such as checks, bills of exchange, cashier’s cheque etc.

Among these, online banking keys are used particularly frequent. The daily operations of enterprises cannot be separated from receipts and payments. Most of the transactions are completed via online banking systems (reflecting the importance of online banking key management nowadays). Generally, online banking payment is divided into at least two levels of management. First, the cashier completes online banking voucher preparation. Then he must pass the approval of a higher-level personnel to complete the whole online banking payment. To ensure the safety of funds, some companies will even set up another layer of review to reduce the error rate.

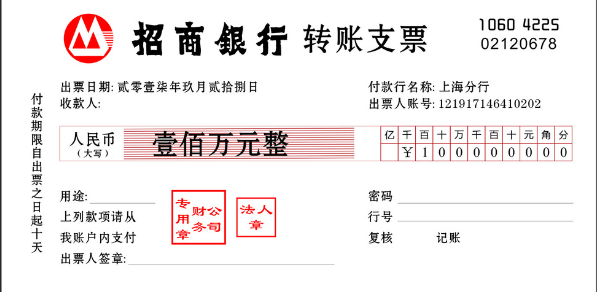

In addition to online banking, another common transaction method in China is the bill payment. They are mainly submitted to the bank for use, requiring the business personnel to accurately fill in the bill information and affix corresponding seals; usually the financial seal and legal person seal.

In practice, many management levels highly prioritize the importance to control and monitor online banking but ignore the chop management. If these chops are kept by the same person, the custodian can directly take the chops to the bank, issue checks, handle bill payments and other businesses. Normally in China, most bill payments only request the financial chop and legal person chop. This poses certain risks to the company. Therefore, we highly suggest that

- The chops, especially the financial and the legal person chop, should be handed over to two separate people for safekeeping to lower risks

- Entrust a professional agency to keep the chops

- ECOVIS Ruide Shanghai can also provide such services to optimize your internal management

Do you have questions or require support for your company chops? Then please do not hesitate to contact either Ecovis Ruide in Shanghai or our colleagues in Heidelberg, Germany from Ecovis Heidelberg!