Thailand: Land of opportunities investment & incentive 2020

Reproduced with permission for Ecovis A. A. C., Thailand, by Chayoot Sripian, Economist, Federation of Thai Industries.

Stepping into the year 2020 began as the most challenging throughout the world, due to the spread of the COVID-19 virus and the trade war between China and US, which has, in turn, slowed down the economy in the region. There are a number of important issues to consider for expanding business in this period. However, there is still plenty of upside for investing in Thailand in what has become known as the “Golden Year of Investment”. The Thai government has granted incentives to attract investors from around the world, including tax incentives in many new S-curve industries, and investor-friendly regulations in the Eastern Economic Corridor (EEC) area.

Eastern Economic Corridor ( EEC )

The EEC project is expected to boost growth in this area and attract investors, who would otherwise look to new emerging markets such as Vietnam or Myanmar. According to the Thailand Development Research Institute (TDRI) the EEC project will have a big impact on foreign investment, as it is forecast to improve Thailand’s economic and infrastructure landscape.

Massive infrastructure projects on the EEC development list included:

- U-Tapao airport expansion. (7.1 billion USD)

- The Map ta Phut deep-sea port expansion (330 million USD)

- Laem Chabang deep sea port (1.1billion USD)

- Double track railway (2.1 billion USD)

- High speed train (2.1 billion USD)

- Motorway (1.1billion USD)

All of these projects will undergo stages of supply chain and construction which will favour both foreign and Thai industry.

12 New S-Curve Industries

The government is promoting and supporting advanced technological development in 12 targeted industries:

- Next generation automotive

- Smart electronics

- Affluent, medical and wellness tourism.

- Agriculture and biotechnology

- Food for the future

- Robotics for industry

- Logistics and aviation

- Biofuels and biochemicals

- Digital industry

- Medical industry

- Defence industry

- Education development

The Board of Investment (BOI) aims to continue supporting these new targeted industries (New S-Curve) as this will drive the Thai economy forward into the next decade. These 12 initiatives, plus the development of the EEC area, are expected to have an enormous impact on the Thai GDP and its circular economy.

If successful, they will transform the country into Thailand 4.0, the Thai government’s economic model designed to create economic prosperity, social security and sustainability – a national strategic plan which will span 20 years. Given the current healthcare crisis around the globe, Thailand can use this as an opportunity for investors who need to relocate or rebalance their portfolio in one country.

Investment Incentives

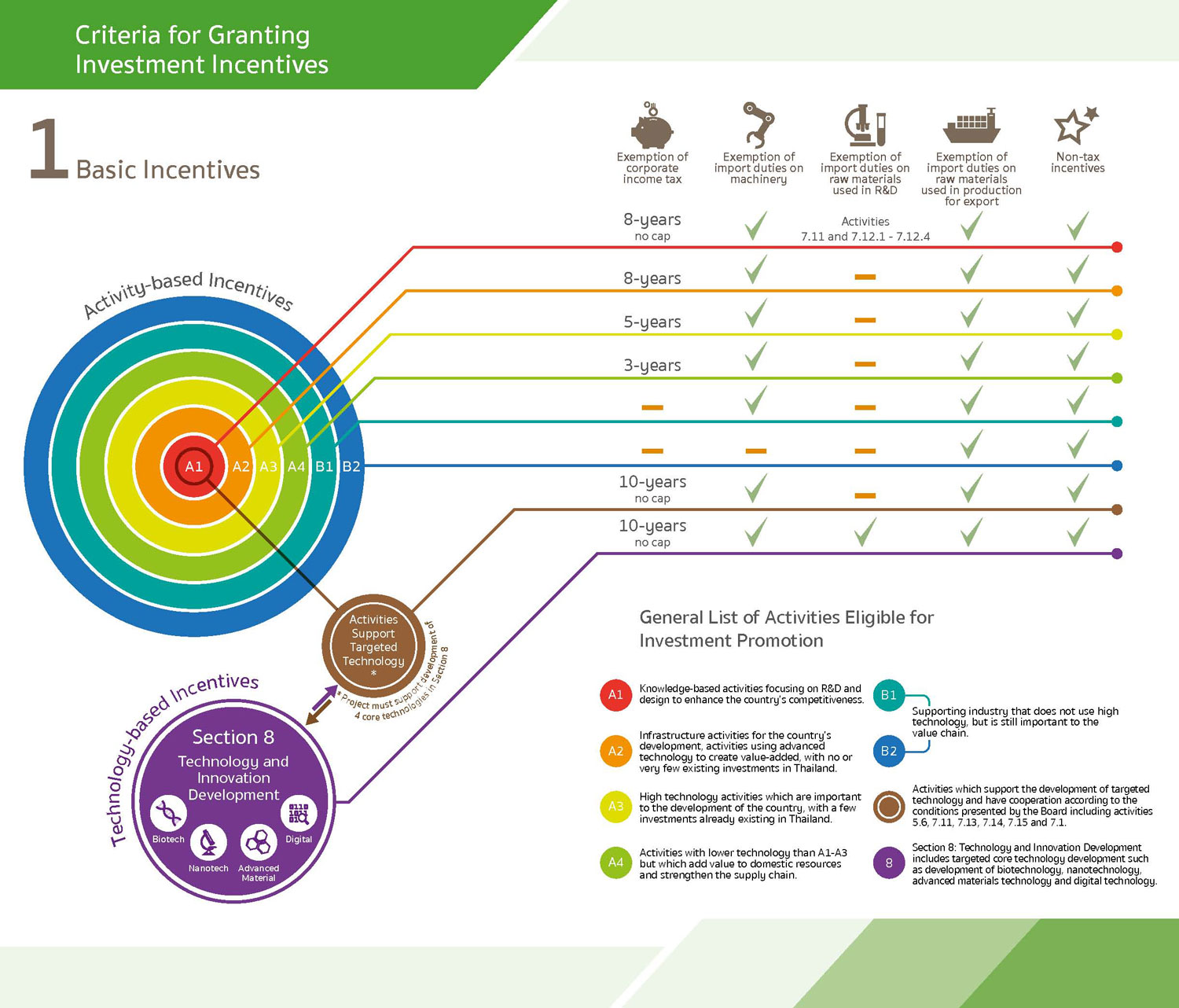

Board of Investment (BOI) will grant incentives based on activity, ie base incentives.

The highest incentive given is from B2, B1, A4 ,A3 ,A2 and A1. Incentives come in categories:

- Exemption of corporate income tax .

- Exemption of import duties on machinery.

- Exemption of import duties on raw materials used in R&D.

- Exemption of import duties on raw materials used in production for export.

- Non-tax incentive.

These privileges can be used from three years up to 11 years if the company is granted an investment incentive privilege through the BOI process.

Key factors for non-tax incentives

- Permit to take out money/ transfer/ remit in foreign currency.

- Permit for foreign Visa into Thailand.

- Permit for skilled worker and expert to work on the project’s promoted activities .

- Permit to own land (if its purpose doesn’t qualify as a BOI promoted activity, a foreign company cannot own land in Thailand).

Key factors for tax incentives

1. Activity-based incentives: New Thailand BOI incentives which are activity-based are classified into the following groups:

Group A: consists of activities that will be given corporate income tax incentives, machinery and raw materials import duty incentives and other non-tax incentives.

A1. Thailand BOI incentives of this group are:

- Eight year corporate income tax exemption without cap.

- Exemption of import duty on machinery.

- Exemption of import duty on raw or essential materials used in manufacturing export products for one year, which can be extended as deemed appropriate by the Board of Investment.

- Other non-tax incentives.

A2. Thailand BOI incentives of this group are:

- Eight year corporate income tax exemption, not more than 100% of investment (excluding cost of land and working capital).

- Exemption of import duty on machinery.

- Exemption of import duty on raw or essential materials used in manufacturing export products for 1 year, which can be extended as deemed appropriate by the Board of Investment.

- Other non-tax incentives.

A3. Thailand BOI incentives of this group are:

- Five year corporate income tax exemption, not more than 100% of investment (excluding cost of land and working capital) unless specified in the list of activities eligible for investment promotion that the activity shall be granted corporate income tax exemption without being subject to a corporate income tax exemption cap.

- Exemption of import duty on machinery.

- Exemption of import duty on raw or essential materials used in manufacturing export products for one year ,which can be extended as deemed appropriate by the Board of Investment.

- Other non-tax incentives.

A4. Thailand BOI incentives of this group are:

- Three year corporate income tax exemption, not more than 100% of investment (excluding cost of land and working capital).

- Exemption of import duty on machinery.

- Exemption of import duty on raw or essential materials used in manufacturing export products for 1 year, which can be extended as deemed appropriate by the Board of Investment.

- Other non-tax incentives.

Group B: consists of activities that receive only machinery and raw materials import duty incentives and other non-tax incentives.

B1. Thailand BOI incentives of this group are:

- Exemption of import duty on machinery.

- Exemption of import duty on raw or essential materials used in manufacturing export products for one year which can be extended as deemed appropriate by the Board of Investment.

- Other non-tax incentives.

B2. Thailand BOI incentives of this group are:

- Exemption of import duty on raw or essential materials used in manufacturing export products for 1 year which can be extended as deemed appropriate by the Board of Investment.