Invest in Cambodia: The Importance of Financial Due Diligence

Tourism, together with clothing manufacturing, construction and agriculture, is one of the four key sectors supporting Cambodia’s economic expansion.

In a major recent development, the Cambodian government removed all travel checks with regards to COVID-19 and is now issuing visas for tourists and for business visits as it was pre-pandemic.

The result of this should be an increase in activity in tourist activities, as well as all areas of business in the Kingdom.

To support this, we have received reports from the various Chambers of Commerce residents in Cambodia that life is slowly returning to normal, especially in the area of business creation and expansion.

This is then a particularly good time to remind our clients, and our ECOVIS offices worldwide with clients potentially expanding into Cambodia, of ECOVIS VSDK expertise in our various business advisory services, including:

- Outsourced Interim CFO

- Turnaround and Restructuring

- Transaction Services

- Risk, Control and System Solutions

- Forensics

- Corporate Finance

In this article we showcase financial due diligence, which is a particular requirement for new companies and those wishing to invest in Cambodian companies.

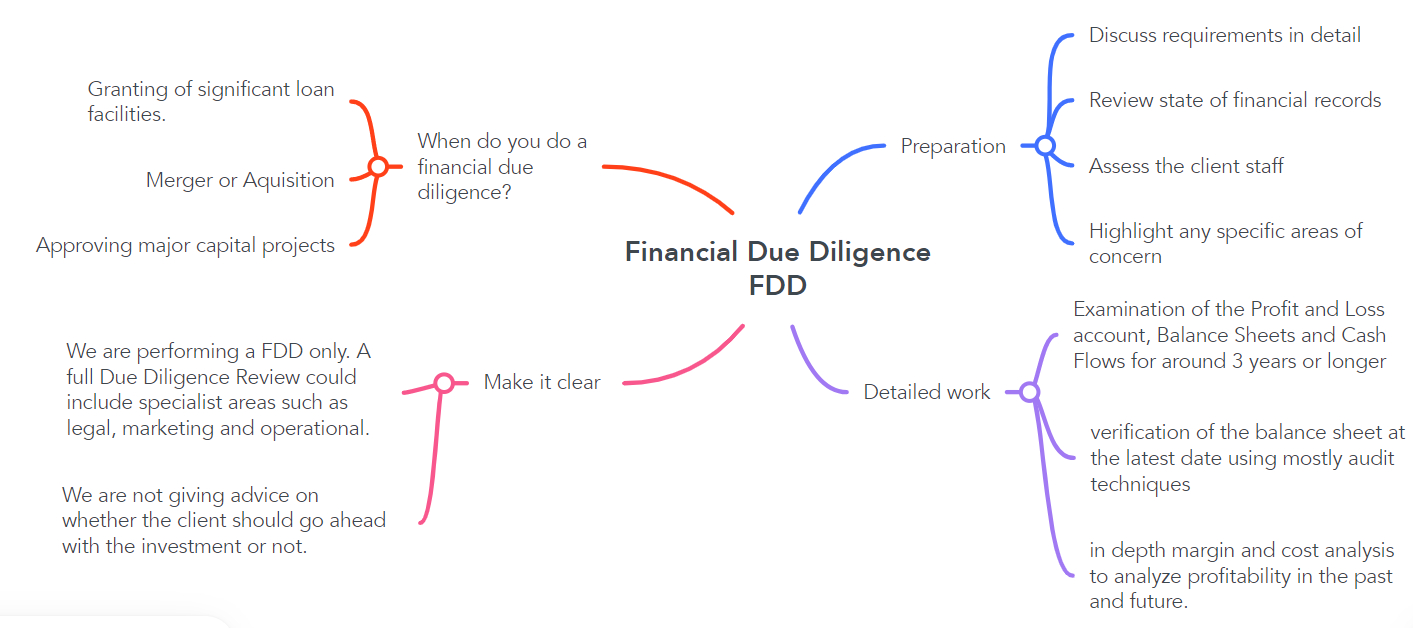

Financial due diligence requires an examination of financial records before entering a proposed transaction with another party. It is an in-depth focused examination, normally carried out before agreeing:

- A merger or acquisition of a business,

- The granting of significant loan facilities.

- Approving major capital projects.

- Any significant financial transaction which will have a major impact on the business.

Banks and venture capital companies usually insist on a Financial Due Diligence Report (FDDR) as part of their own verification process before they will extend facilities in any deal. They will often issue detailed instructions on what they want to cover and how they want the results of the review to be presented.

Note that a financial due diligence is often part of a wider investigation, which can include specialist areas such as legal and operational investigations. It is very important to work closely with all parties to ensure that any areas of overlap are agreed properly.

Although this examination process often uses audit techniques, an audit report is not normally a legal requirement and usually there is no formal opinion expressed.

The normal life cycle of a financial due diligence report could be:

- Discuss requirements in detail using the latest reliable financial accounts.

- Review the state of the financial records and whether the documentation will support a review.

- Assess the finance staff of the client.

- Highlight any specific areas which may be of concern.

- Agree the purpose of the review. In most cases the main work starts with a historical examination of the Profit and Loss account, Balance Sheets and Cash Flows for around three years or longer, to gain an understanding of the reliability of the accounts.

- Carry out a verification of the balance sheet at the latest date using mostly audit techniques to verify balances.

- In some cases do in depth margin and cost analysis to analyze both past and future profitability. We may perhaps create discounted cash flow analysis to assist in investment valuation.

- Make the purpose and scope of the review clear and agree this with all stakeholders. Ensure that the scope is signed off with an agreed timetable and key milestones.

- Make sure that all stakeholders are aware that we are not giving advice on whether or not the client should go ahead with the investment.

So, if you are looking to invest in Cambodia, financial due diligence is crucial. For assistance in this matter please don’t hesitate to contact us.

Contact us:

ECOVIS VSDK & Partners

#17, Street 135 (Corner Street 500),Sangkat Phsar Derm Thkov, Khan Chamkar Morn

Phnom Penh

Phone: +855 61 766 168 / +855 89 520 005

www.ecovis.com/cambodia

Murray Macmillan

- Cambodia

- ECOVIS VSDK & Partners

- +855 81 598 165

- Director of Financial Advisory