Tax exposures in emerging countries

In May 2015, the Ministry of Economy, Trade and Industry of Japan (“METI”) announced a report regarding tax exposures in emerging countries.

Tax assessment cases in countries where Japanese companies are making inroads:

- The METI conducted a taxation survey of 4,286 Japanese companies with subsidiaries overseas and received responses from 1,081 of them.

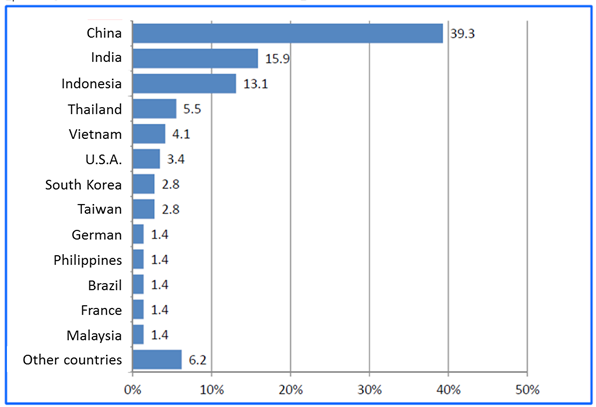

- Tax assessment cases which result in double taxation have been reported in a total of 145 cases. China had the most, with 39.3%, India 15.9% and Indonesia 13.1%.

Tax assessment cases by country (within the past 6 years):

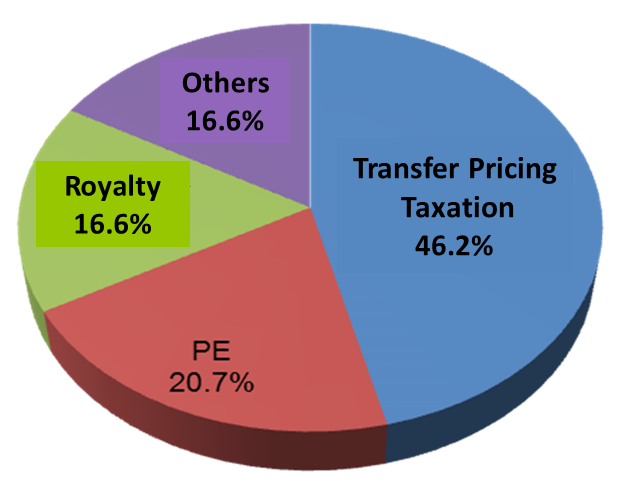

- These assessment cases related to transfer pricing (46.2%), PE assessment (20.7%), and royalties (16.6%).

The matters of the assessment cases (within the past 6 years):

(All) (n=145)

The matters of the assessment cases:

No. | Category | n | % | |

TP | 1 | Increase | 31 | 21.4 |

2 | Increase | 25 | 17.2 | |

3 | Other | 11 | 7.6 | |

PE | 4 | Employee | 18 | 12.4 |

5 | Subsidiary | 8 | 5.5 | |

6 | Rep | 4 | 2.8 | |

Royalty | 7 | Different | 10 | 6.9 |

8 | Royalty | 3 | 2.1 | |

9 | Royalty | 2 | 1.4 | |

10 | Royalty | 9 | 6.2 | |

11 | Others | 24 | 16.6 | |

Total | 145 | 100.0 |

Current issues in tax assessment cases

In recent years, tax assessments have been occurring frequently in emerging countries in accordance with the unique tax assessment approaches of those countries as distinct from global standards.

It has become essential to deal with these cases effectively to overcome global competition. There are the following reasons / background for such assessments by tax authorities in emerging countries:

- Lack of human resources who are experts in cross-border taxation,

- Ambiguity in legal system,

- Considerable discretion on part of tax examiner, etc.

On the other hand, overseas subsidiaries of Japanese companies cannot handle tax matters approxiprimately in emerging countries because of lack of human resources who are tax experts, who have only limited knowledge, or given a lack of communication between parent companies and subsidiaries.

Taking these factors into account, it is necessary to consider from various angles the character of individual assessment cases in each country and the development of human resources for handling future tax cases in emerging countries.

Features of tax authorities in each country (example):

Tax Authority | Relief Process | |

China |

|

|

India |

|

|

Indonesia |

|

|

Brazil |

|

|

Vietnam |

|

|

Thailand |

|

|

“A recent report by METI concerning tax assessment cases in emerging countries contains some vital information. This article outlines that report.”

Yoshiaki UNO, ECOVIS XAT Tax Corporation, Japan

Author

Yoshiaki UNO

yoshiaki.uno@ecovis.com