Newsletter September 2023

You will find below the new issue of our Newsletter (September 2023).

measures

A few days ago, Moody’s upgraded Greece profile to Ba1 stable, following the positive outlook of the Greek Economy. Now, further measures have been released towards a prosper economy. The latest Anti-money Laundering and tax evasion measures will be in effect from the 1Q, 2024. The new charters aim at a real-time

digitalization of accounting and tax services. Demonstratively:

- The extension of the MyData tool to up to 100% coverage to all industry lines;

- The full application of EFT/POS;

- POS is being interfaced with cash registers;

- Electronic invoices will be sent through the MyData application.

- The rise of banking and card transfers.

Especially for the former, the fines for cash transactions above 500 euros will double in the New Year. In short, the purpose is to increase banking/e-banking remittances and cards to record business daily revenue and eliminate tax evasion.

All financial data will be connected electronically in real time to the Greek Independent Authority of Public Revenue (myAADE). Minimizing the use of cash by the usage of more electronic means of payment has the purpose of fully automated audit procedures robusting the economy and leading the Greek economy to a digital era.

Cash elimination is the next target of the new legislation for Real Estate. As of January 2024 onwards, Real state Contracts will be monitored mainly from the myProperty application, and all related transactions should only take place through the banking system. No cash monies will be acceptable.

Indistinguishably, Athens applies stricter rules on short-term leases like Madrid and other European countries did before. Greek Airbnb-like short-term leases are also getting stricter rules, allowing a maximum stay of 60 days. The cost will also be raised including the climate change or green fee and the hospitality levy (telos Parepidimounton).

Just as important are the next steps of upgrading the ATHEX, the user and the potential users of which are getting further tax motivations.

Since today, a real estate property compensation was through cash, a bank check, electronic bank or in a mixture of the aforementioned. Moving ahead to January 2024 those kinds of transfers will be settled explicitly via electronic means of a banking transfer.

The upcoming legislation on the exclusive purchase and sale of real estate through banks aims to diminish tax evasion. As per my Property application, two years ago around forty-two thousand properties were fully repaid in cash, while today one out four of such transactions are executed through a mix of electronic and cash means, resulting in around 2.981 million euros of recorded transactions.

At the same time, tax authorities have accelerated Real Estate audits, especially for transactions exceeding one hundred thousand euros and for those with a less than 30% estimated value before the transaction in the year 2017. The authorities are focused on abnormalities of the contract’s price to the actual transaction price for

similar property sizes and the state of the tax exemptions.

Following other European Countries, Greek short-term leasing became more rigorous. The first thing that has been amended is the definition of Short-term leases itself, which now states that they are rental or sub-rental as published in the related online platform, which provides no other services than an accommodation that does not exceed 60 days and bed linen, while other countries have set this limit to 90 days.

The main changes are:

- The amendment on the definition of the Short-term leasing;

- The launch of a new business Code Activity Number (KAD) for those kinds of hospitality activities;

- The Individual owners of more than three properties of such short-term leases should start a business activity under that new KAD and will be treated as business entities;

- The entity owners carrying such an activity will be subject to VAT, and their cost will be similar to “Rooms to Let”, including a hospitality Levy and green tax instead of the latest municipality or accommodation tax.

- The latter, the municipality tax, will be replaced by the green tax levy and increases all types of accommodation

The Updated accommodation costs per category

| Category | Cost per day (in €) | Increase (in €) | |

| Prior: Municipality tax per day(in €) | Now: Green levy per day(in €) | ||

| 1-2 stars | 0,50 € | 1,50 € | 1,00 € |

| 3 stars | 1,50 € | 3,00 € | 1,50 € |

| 4 stars | 3,0 € | 7,00 € | 4,00 € |

| 5 stars | 4,00 € | 10,0 € | 6,00 € |

| Rooms to let | 0,50 € | 1,50 € | 1,00 € |

| Short term leasing | 0,00 € | 1,50 € | 1,50 € |

The first reactions to those announcements were mixed as the hotel owners might experience a fairer competition but, at the same time, they are cautious with the raised accommodation costs.

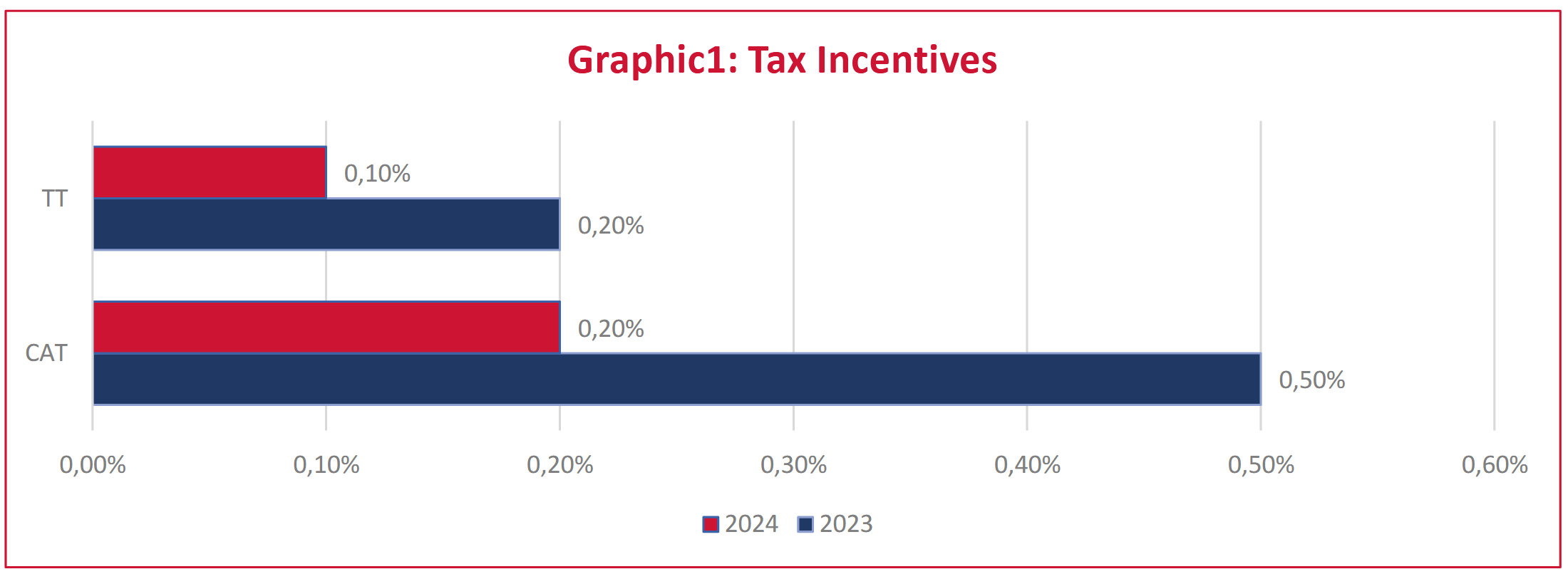

Since the first day of 2024, funding and project’s financing transactions will be facilitated with a decreased

capital accumulation tax (CAT) at the rate of 0.2% instead of 0.5% as set today while the transactional tax

(TT) for listed securities is decreased by 50% to 0.1% from 0.2%.

Contact us:

ECOVIS HELLAS LTD.

10 Solonos str.

106 73 Kolonaki, Athens

Phone: +30 210 3645471 /

+30 210 3842325