How to close a company in Germany

Companies in Germany may want to close their business for various reasons such as changes in their business scope, due to financial problems, or failure to adapt to the market. Or nowadays, another important factor might the coronavirus (COVID-19) outbreak. Whatever the reason is for this decision to shut down the business, investors cannot simply abandon the company, or stop trading and walk away without following proper closure procedures, as it´s not enough to simply start doing business or selling products when opening a business. In another article “Setting up a company in Germany” we outlined all the requirements necessary to set up a company in Germany. In this article we will outline the necessary steps and important information regarding winding up a German GmbH (Limited Liability Company).

For companies considering closing their operations in Germany, their should know that it´s important that the company closure is carries out correctly. We strongly suggest that companies should consider the engagement of qualified and experienced German corporate lawyers. At Ecovis Richard Hoffmann, our team of legal professionals will guide you through the regulation jungles and ensure that companies are closed in the correct manner and by a cost-efficient way. Contact us for an initial consultancy free to charge.

- Reasons and types of closing a company in Germany

- Steps of company closing in Germany

- Company deregistration without liquidation and without a “waiting year (Sperrjahr)”

- Our take-aways

1. Reasons and types of closing a company in Germany

There are different reasons to close a company. Most of the legally defined reasons for the liquidation of a GmbH are defined in § 60 GmbHG:

- Resolution of the shareholders to dissolve and liquidate the GmbH. If nothing else was determined in the articles of association, for such a resolution a majority of three quarters of the voices delivered is necessary

- If in the articles of association, expiration of the “lifetime” of the GmbH is specified

- If a judicial decision or a decision of the administrative court or the administrative authority in the cases of §§ 61, 62 GmbHG determines the liquidation of the GmbH

- Initiation of insolvency proceedings

- Rejection to initiate insolvency proceedings due to a lack of assets

- Declaration of the Register Court that the articles of association have been found to be invalid or incomplete in essential points

- Order of deletion due to a complete lack of assets

The termination of a GmbH can also have reasons which are not expressly mentioned in the GmbHG. In a nutshell, there are two main manners in which companies are wound up: compulsory closure and voluntary closure. In this article we will primarily focus on voluntary closure.

2. Steps of company closing in Germany

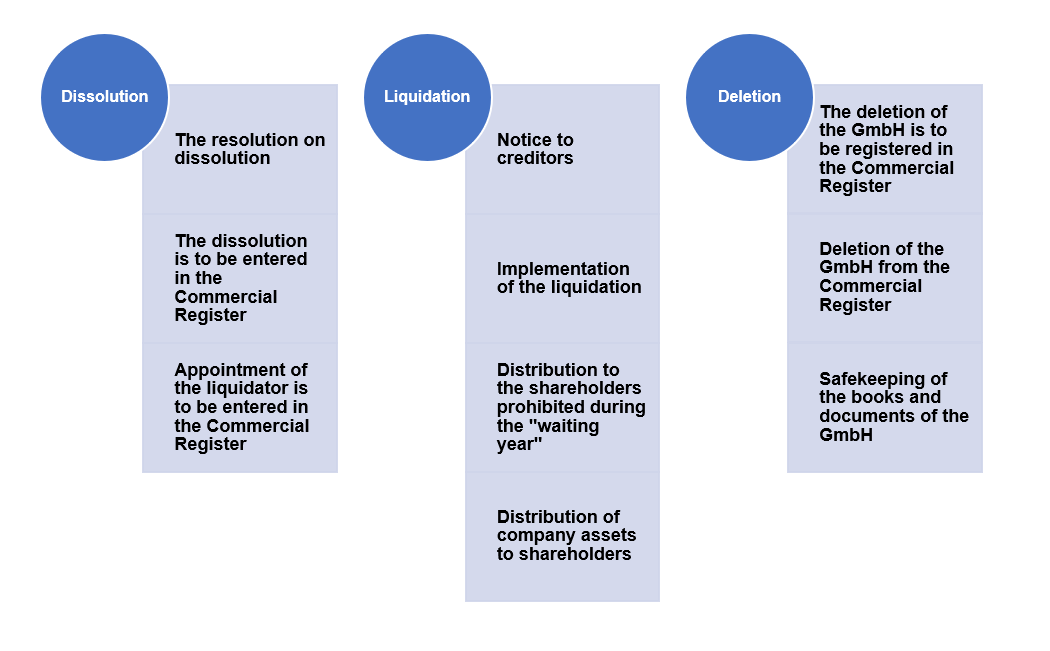

The existence of a GmbH is inseparably bound up with its entry in the Commercial Register. Accordingly, a GmbH exists until it is deleted from the Commercial Register. The way to do this requires a certain procedure as well as a corresponding time schedule. To terminate a company in Germany there are three steps involved:

- Dissolution

- Liquidation

- Deletion

Dissolution (Auflöschung)

The dissolution phase marks the beginning of the liquidation of a GmbH. Important: The legal personality and capacity to act of the limited liability company continue to exist until it is deleted from the commercial register. Only the purpose of the company changes during this phase. Instead of operating economically, the company is to be liquidated. A GmbH in liquidation is given the addition „i. L.“. (in liquidation) or „i. Abw.“ (in liquidation), which indicates this status to the business partner. You must also include the addition in your business documents, like XXX GmbH i.L.

If you would like to dissolve a GmbH on your own initiative, the first step is usually a corresponding resolution by the shareholders. Unless you have otherwise agreed in the articles of association, the resolution requires a majority of three quarters of the votes cast.

The dissolution of the company must be submitted in notarial certified form to be entered in the Commercial Register. Responsible is the local register court where the company is registered.

In addition to the dissolution, the liquidators must be appointed and also entered in the Commercial Register. In principle, any natural person with full legal capacity can become liquidator, which also applies for the role of managing director (Geschäftsführer) of a company.

- Acting managing directors are appointed as liquidators by law automatically, without any special appointment act, unless otherwise regulated by the articles of association, shareholders‘ resolution or court order.

- Whether the managing director is obliged to continue his activity in the role of liquidator depends on the employment contract and is to be affirmed in case of doubt. This is because the case of liquidation is not in itself an important reason for termination.

- The appointment of a liquidator by shareholders‘ resolution is also allowed in any case, i.e. even if a liquidator is appointed in the articles of association.

- In exceptional cases, liquidators may be appointed by the register court.

If acting managing directors do not become liquidators, their power of representation expires. The liquidators may also be dismissed in the same way as they were appointed. The role of liquidator is a vital one as they will represent the company and be responsible for these complicated proceedings. It is critical to appoint an appropriate person to be the liquidator. Contact us to know more about appointing our lawyer to be the liquidator of your company.

Liquidation

After the dissolution, the phase of the GmbH liquidation begins. The liquidator(s) are responsible for the proper liquidation.

Upon this announcement of the liquidation, the so-called “waiting year” (Sperrjahr) begins. The “waiting year” serves to protect creditors. It begins on the day on which the notice to creditors is published. During this period, no assets of the GmbH i. L. is allowed to be distributed to the shareholders. During this time, it is only permitted to settle claims of third parties. There is no ranking among the creditors.

Duties of liquidators

Like the managing directors of the GmbH, the liquidators are the legal representatives of the company i. L. After the dissolution, the liquidation phase begins. The liquidators are responsible for the proper liquidation. Their duties are laid down in §§ 70-73 GmbHG. Among other things they must:

- announce the liquidation in the Federal Gazette (Bundesanzeiger)

- terminate the current business of the company

- fulfil the obligations of the GmbH i. L. (satisfy the creditors)

- collect receivables

- convert the assets of the company into cash

After the dissolution is registered in the Commercial Register and published. The liquidators must notify all outstanding creditors to file their claims with the liquidators. The “waiting year” begins with the notice. Before the end of this year, the distribution of the assets to the shareholders is not possible.

In addition, the liquidators carry out the tasks that would otherwise fall to the managing directors. This means that they represent the GmbH i. L. externally (also in court) and are – and the law places a particular emphasis on this – responsible for proper bookkeeping. This includes among other things an opening balance (Eröffnungsbilanz) including explanation at the beginning of the liquidation and a final balance (Schlussbilanz) at its end. In the case the liquidation is planned for a longer period, like multiple years, annual interim balance sheets shall be prepared as well.

It is important that the liquidator keeps an eye on a possibly upcoming insolvency of the GmbH i. L. and if necessary, fulfils his obligation to inform the responsible judge and file for insolvency.

The company is liable for damages resulting from unlawful acts committed by the liquidator while performing his duties. And the liquidator is liable to the company, any shareholder and creditor of the company for damages caused by wilful or negligent violation of his/her duties.

Deletion

After all the liabilities have been cleared, the assets of the liquidated company are to be distributed to the shareholders. The distribution may take place until the expiration of the “waiting year” or before the expiration of that one year provided that a confirmation of a specially qualified auditor that all creditors´ claims have been settled.

With the distribution of assets to the shareholders, the work of the liquidator for liquidation is finished. Thereafter, the liquidator only has reporting obligations to the court. The liquidator must register the end of the liquidation and thus the termination of the GmbH and enter it in the Commercial Register. The liquidator must sign the registration with the notary. The final balance sheet must be sent to the court along with the registration as well. The company is deemed to be terminated when the completion of the liquidation and the deletion of the company is entered in the Commercial Register. The company thus ends its existence.

Keeping of books of the company

After completion of the liquidation, the books and records of the company must be given to one of the shareholders or a third party for safekeeping for a period of ten years.

Subsequent liquidation

If, after the deletion of the company, it turns out that assets are still available or liquidation measures are to be carried out, a subsequent liquidation must be carried out. The company will then re-enter the liquidation proceedings. In order to become capable of acting again, new liquidators must be appointed either upon application or by the register court.

After the end of the subsequent liquidation, it must then be noted that the power of representation of these liquidators for the GmbH has expired again.

3. Company deregistration without liquidation and without a “waiting year (Sperrjahr)”

In (rare) exceptional cases, a company can also be deleted from the Commercial Register without liquidation and thus also without the “waiting year” (Sperrjahr).

In these cases, the waiting year may be waived if the company’s assets are no longer distributable. Such an exceptional case exists if the liquidator declares that the company’s assets do not exist, that no payments on shares are outstanding, that there are no claims and receivables from third parties including the tax authorities, that no legal disputes are pending in which the company is involved, and that there is also no case of insolvency or over-indebtedness.

The termination of a GmbH without a “waiting year” is carried out following a structured scheme. Continuous legal assistance is highly recommended, as the entire process of the liquidation needs to be backed up with sound specialist knowledge. Thus, the company needs to have an experienced and qualified expert at its side who provides information on all legal and financial requirements and takes over the preparations for the dissolution of the GmbH. In addition, it must be precisely assessed in advance whether there is a proven lack of assets. You can then find out how the process will proceed.

4. Our takeaways:

Our services – Closing a company in Germany

At Ecovis Richard Hoffmann, our corporate lawyers will guide you through the closure proceedings and assure you that the closing of the company will be carries out in the proper legal manner. Our team of financial and tax professional can oversee the financial side of the operation and prepare the financial statements, liquidation balances and tax returns.

We provide:

- Company´s registered address during liquidation process

- Corporate secretarial services to keep the company in good standing

- Ongoing bookkeeping

- A liquidator (Ecovis employee)

- Prepare the required documentation

- Organisation, coordination and communication with a German notary in relation to registration of the dissolution, appointment of the liquidator and the removal from the trade register (Gewerbeanmeldung)

- Mandatory publications with the Federal Gazette

- Retention of the books and records for the legally required minimum period of ten years

Free initial consultation to examine your situation

Closing a company is associated with a large amount of organizational effort. Therefore, an experienced and qualified legal expert by your side is necessary to be able to analyze the lack of assets and to choose the appropriate procedure. Our summary is only a compact information. The winding-up of a company must be clarified in each individual case.

Our legal team can advise you and accompany you through the whole process in German, English or Chinese. We offer you a free initial consultation and performance review, and we will be happy to examine the prospects of success of terminating your company without a “waiting year”.

Us to be your liquidator

The liquidator of a GmbH is subject to the same strict rules as the managing director of a company. Moreover, the liquidator is personally liable in case of a breach of the “waiting year” ban.

A liquidator who negligently forgets a creditor in the course of the liquidation of a GmbH with subsequent deletion from the commercial register is personally liable to pay damages to that creditor. Although the amount of this compensation is limited to the amount of the distributed amounts, depending on the financial resources of a GmbH, significant amounts of liability against the liquidator of a GmbH can be reached here.

The liquidator must therefore exercise the greatest possible care in the liquidation of a GmbH in the settlement of liabilities. Contact us today, our corporate lawyer can advise both liquidators and creditor, or be appointed to be your liquidator.