Using dividend reinvestment in China could defer withholding tax. How does that affect German (foreign) shareholders?

Withholding Tax Under the Chinese Tax Policy

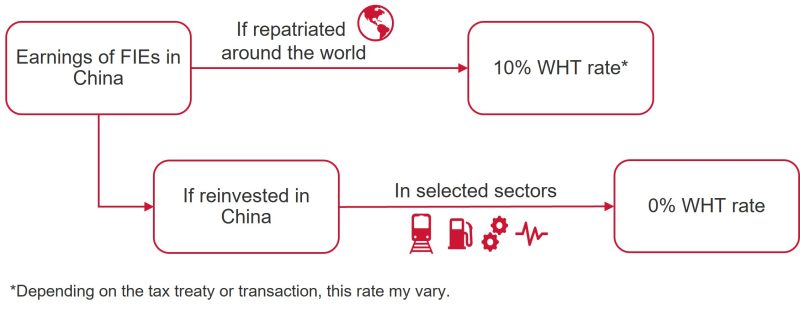

According to the Enterprise Income Tax Law in China, for non-resident enterprises to obtain dividends from domestic resident enterprises, enterprise income tax should be levied at a 10% tax rate.

However, for dividends and bonuses obtained in accordance with bilateral tax treaties, tax rates can be implemented in accordance with the provisions of tax treaties. Taking Germany as an example, based on the double tax agreement between China and Germany, the withholding tax rate for profit distribution is 5%.

But if foreign investors directly use profits for direct investment, then this part of the tax can be postponed. How to operate it? Please refer to this article.

Overseas Investors Can Temporarily Not Levy Withholding Tax on Distributed Profits Used For Direct Investments

If overseas investors reinvest their profits from a resident enterprise in China for direct investment, they can postpone the withholding tax in China. Via reinvesting equity in any non-prohibited investment sector, non-resident companies are now able to defer withholding tax payments. Before, it was limited to encouraged sectors . So, the withholding tax deferral policy is now more open to more application and also more flexible.

There are some important conditions, an overseas investor must follow in order to not levy their taxes:

- The policy of temporarily not imposing withholding tax on profits distributed to overseas investors is being expanded. This policy applies to investments made by overseas investors using their received profits, such as investing in equity, increasing capital, starting new businesses, or acquiring shares. However, it does not include investing in listed company shares, unless it is a qualified strategic investment.If the profits are received by a foreign investor, they have to be the returns from the equity investments (e. g. dividends and bonuses), which are actually distributed by a resident enterprise in China from its realized retained earnings to investors.

- Cash payment of the profit is also allowed. But then, they have to be directly transferred out of the account of the owning company into the investee company. Skipping and transferring the money over any domestic or overseas account in the way is not allowed.

If the conditions are met, the company can file the tax return following the guidelines from the tax administration.

But imagine that I am a totally new foreign investor in the Chinese business and did not know that I am eligible and therefore did not receive my benefits. The law states, that one can apply to enjoy the policy within three years of making the tax payments. If approved, they will receive a refund of the tax paid.

But, how hoes reinvestment work?

After figuring out how to defer tax payment, we need to clarify “reinvestment”. The answer is less complicated than one might think. There are four given ways foreign investors need to use for reinvesting their profits:

- Acquisition of equity from non-related parties of Chinese tax resident enterprises

- Invest or establish a resident company in China

- Assignment or increase of capital reserves in Chinese resident companies

- Other methods accepted by the authorities

Advantages Under This Policy

Many investors may wonder, what are the benefits to investors under this deferred tax policy of reinvesting profits? The two most obvious advantages for investors are:

- Better control over cash flow

- To expand business and operation

Reinvesting dividends into Germany

Germany is known for its incredibly complex tax system. So it will also be interesting to know, what will happen if dividends are transferred from China to Germany; how withholding tax is managed for foreign dividends. Every country has their own withholding tax rates and individual rules. Dividends are taxed again in Germany. To prevent a double taxation, Germany has a double tax treaty with many other countries. This ensures that the foreign withholding tax is credited when investment income is taxed in Germany. The German custodian bank (they receive the net dividend of the investor) is allowed to deduct a maximum of 15%. If the withholding tax is in excess, the investor can refund the money in the respective source country. As an example: for a dividend worth 1,000 EUR, the domestic bank will consider the 150 EUR which were deducted abroad. Instead of the originally due amount of 264 EUR (25% capital gains tax + solidarity surcharge), investors then only pay 114 EUR in capital gains tax to the German authority.

The tax rate on dividend payments is 25% – on foreign or domestic dividends. In case of China, they levy a tax rate of 10%. On this tax rate, refund is not possible. Hence the full 10% shall be paid with another 15% left over tax to pay in Germany. In the first step, the foreign withholding tax is levied on the flat rate withholding tax via the custodian bank. If there is a surplus, it will show on the certificate for tax purposes end of the year.

But what happens if the tax rate is over 15%? Investors can refund the difference between the 15% and the respective rate at the foreign financial authority. But this refund process is often quite complicated. For Germany, the documents can be found on the website from the “Bundeszentralamt für Steuern”.

For some countries, the investor can do the refund process on his own, but some require the involvement of a custodian bank. These banks often charge very high costs for their service. Most banks offer a double tax agreement warrant (Vollmacht zur Durchführung von Steuererstattungen und Vorabbefreiungen gemäß Doppelbesteuerungsabkommen). In this service, they will take care of:

- Submitting applications for full or partial upfront exemption or refund of foreign withholding tax to the relevant foreign tax authorities,

- Obtaining the necessary proof of residence confirmation from the relevant tax office, and

- Handling procedural correspondence with domestic and foreign tax authorities.

Even though this sounds very helpful, one should always inform yourself very carefully about the costs. The costs may deviate a lot between the banks and could already cover a large portion of the to be refunded withholding tax.

Getting the money back in this case is a very long and complicated procedure. Refund applications are costly and must be paid attention to. The German tax authorities state the required documents on their website, but researching the current tax rates is individual initiative.

Hence, foreign investors need to pay attention to the total costs, when foreign dividends are invested or reinvested into the German market. Inform yourself about the withholding tax rate. Ecovis Ruide Shanghai is a highly specialized tax and law firm and will support with this process.

Our legal and tax advice

We strongly advice to pay attention and research when investing dividends between two countries, especially between Germany and China. Getting help and support is also suggested, to make sure that the whole process runs smoothly. Taxes have always been a challenging topic; misunderstandings lack of knowledge can often lead to penalties and problems with the tax bureaus. Our law firm Ecovis Ruide in Shanghai is specialized in supporting German and Chinese companies; either on tax or law support. Foreign investors need to make sure, that they meet the eligible criteria, liaise with the tax bureaus and make sure the process is executed properly.