Adjustment of the new maximum limits of insurable earnings and the amounts corresponding to the respective insurance classes, effective 1 January 2023

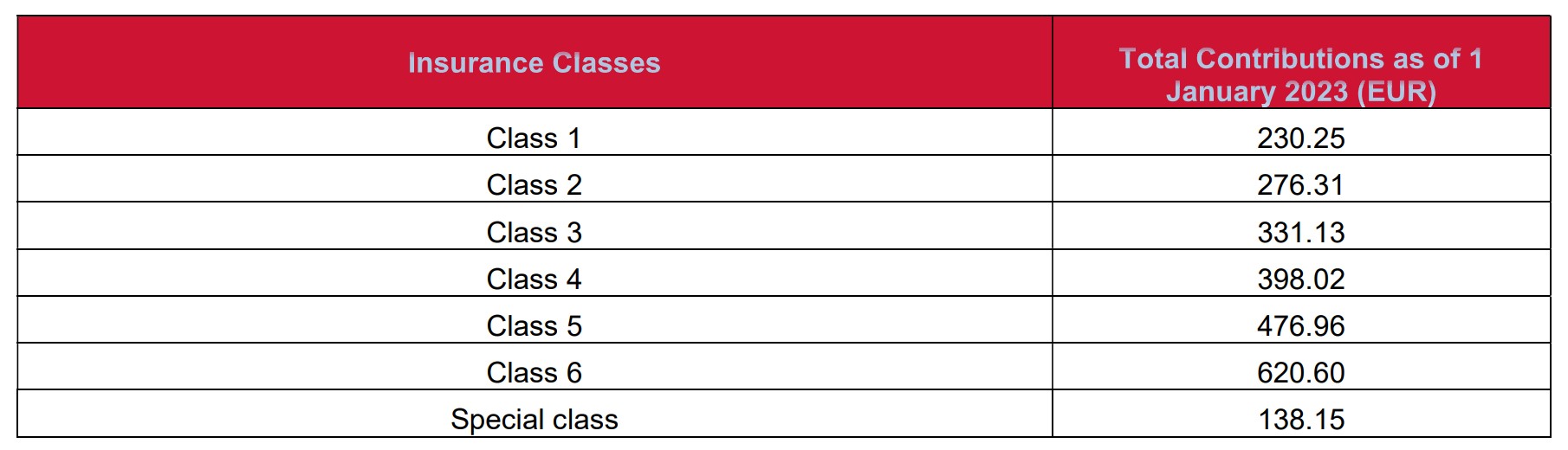

In accordance with Ministerial Decision No. 30/01/2023, the insurance classes of self-employed individuals and freelancers are now determined as follows:

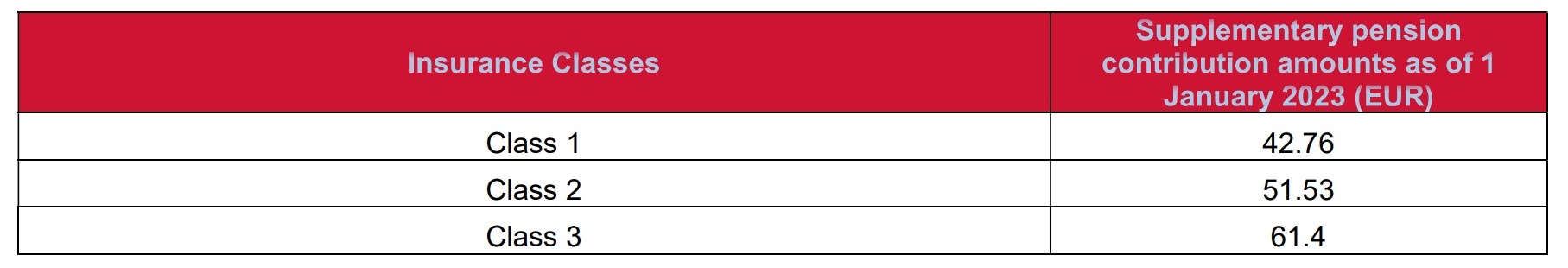

Pursuant to the provisions of Art. 97(3) of No. Law 4387/2016, the amounts of the insurance classes for the payment of the monthly supplementary insurance contribution for self-employed persons, freelancers, and self-employed lawyers and engineers under the Supplementary Insurance Branch of the e-EFKA (National Social Security Agency) and the TEKA (Auxiliary Pensions Defined Contributions Fund) are also increased and set as follows:

At the same time, the maximum insurable earnings of employees under Art. 5(2)(a) and Art. 38(2) of Law No. 4387/2016, upon which the calculation of the monthly insurance contribution of employees and employers is based, is now increased by 9,645262611330377% and set at EUR 7.126,94.

Contact us:

ECOVIS HELLAS LTD.

10 Solonos str.

106 73 Kolonaki, Athens

Phone: +30 210 3645471 /

+30 210 3842325

This article is part of the Newsletter March 2023.