Tax policy in Vietnam: Extension of Payment Deadlines for Tax Payables and Land Leases in 2023

The Vietnamese government has taken tax policy measures to relieve the economy after the Coronavirus pandemic. This includes a package of deadline extensions for tax payments and land leases. The decree came into force on 14 April 2023 and is valid until 31 December 2023.

As part of various measures to promote the economy, the government issued Decree No. 12/2023/ND-CP on 14 April 2023. The experts from ECOVIS AFA VIETNAM explain how companies can use the extended deadlines for tax payments and land lease fees and thus remain liquid for necessary investments and growth.

Which companies belong to the regulated taxpayers

- Taxpayers, i.e., enterprises, organisations, business households, and business individuals who generate their income in 2022 or 2023 in the economic sectors specified by the decree (see box at the end of the article), including

- Branches of enterprises and/or affiliated entities which separately declare VAT/ CIT directly to their supervisory tax authorities and conduct business or manufacturing activities in the specified sectors

- Those who conduct various manufacturing and business activities including the specified activities

- Small and micro enterprises

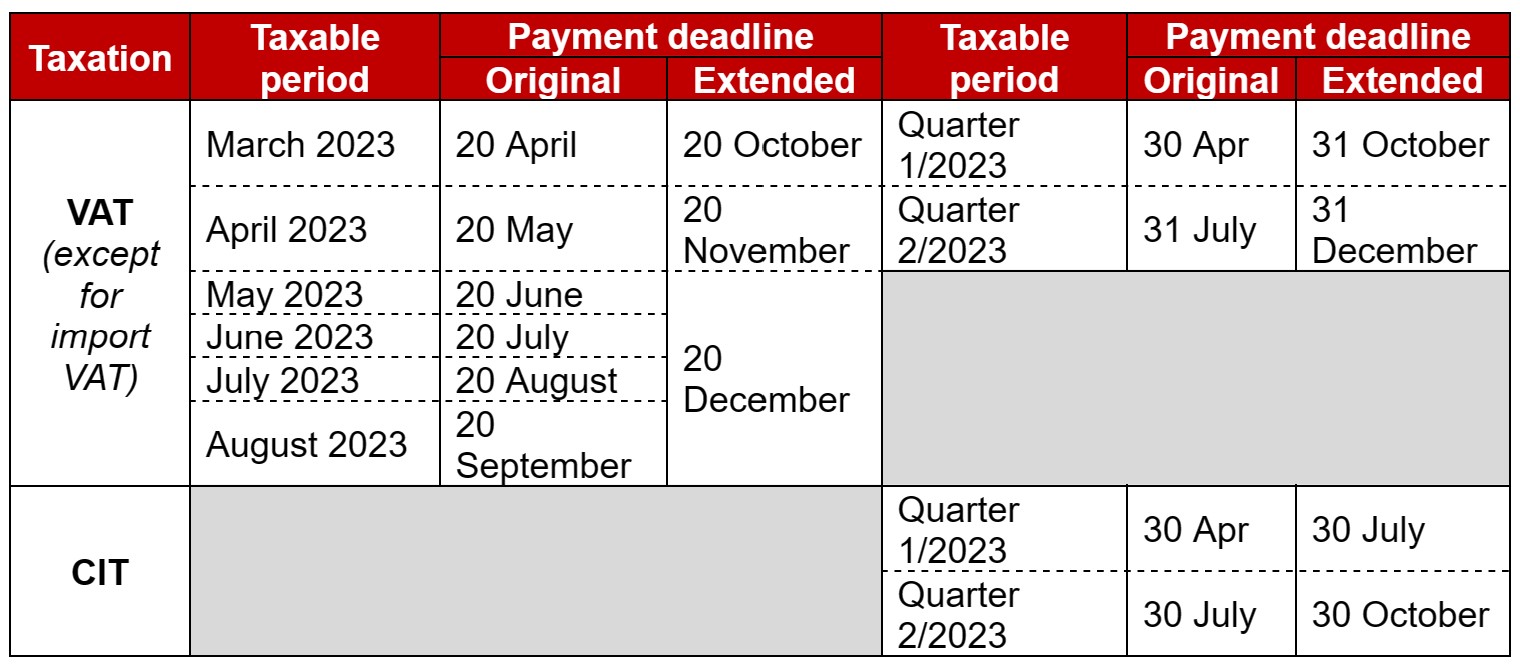

Overview of the extension deadlines for tax payments

Source: Ecovis

VAT and PIT payments of business households and business individuals incurred in 2023 are extended until 30 December 2023.

Extension to deadlines for 50% of 2023 land lease fees: extended by 6 months from 31 May 2023 to 30 November 2023.

We will be happy to apply for an extension of the deadline for tax payments and land lease payments on your behalf.Tran Duong Nghia, Partner of Tax, Accounting and Consulting, ECOVIS AFA VIETNAM, Da Nang City, Vietnam

The administrative process

- Submission deadline: no later than 30 September 2023 (can be submitted at the same time as statutory deadlines for the monthly/quarterly tax declaration)

- Place of submission: the supervisory tax authority

- Result release: the tax authority will only issue a written disapproval notification if it determines that the taxpayer is not eligible for the extension regulation

- Exception: taxpayers must pay the additional tax payables due with the supplementary returns immediately if such returns are submitted after the end of the corresponding extension period

How industries must generate their revenue

- Manufacturing activities (defined according to Decision No. 27/2018/QD-TTg):

- Agriculture, forestry, fishery

- Food processing and production

- Textile: apparel production; leather and related product manufacturing

- Wood processing and wood, bamboo product manufacturing (except for beds, cabinets, seats, chairs, tables)

- Hay, straw, and plaiting material product manufacturing

- Paper and paper product manufacturing

- Rubber and plastic product manufacturing

- Product manufacturing from other non-metallic alloys, metal manufacturing, mechanical engineering, metal treating and cladding

- Electronic appliances, computer, and optical product manufacturing

- Automobile and other motorised vehicle manufacturing

- Bed, cabinet, seat, chair, table manufacturing

- Construction

- Publishing, cinematography, television programmes, audio recording, music production

- Crude oil and natural gas exploitation (no extension for CIT payments of crude oil, condensate and natural gas)

- Beverage production

- Printing, copying

- Coke, refined petroleum processing, chemical production, prefabricated metal products (exc. machines, equipments)

- Motor, motobike manufacturing

- Repair, maintenance and installation machines

- Drainage and sewage treatment

- Business activities (defined according to Decision No. 27/2018/QD-TTg):

- Transport and storage

- Accommodation, food and drink

- Education and training

- Medical and social assistance

- Real estate trading

- Labor and employment services

- Operation of travel agents, tour operators, and services assisting or relating to advertisement and organisation of travel tours

- Composing, artistic, recreational activities

- Operation of libraries, archives, museums, and other cultural activities

- Sports and recreational activities

- Movie screening, radio and television broadcasting

- Computer coding, consulting services, and other activities relating to computers

- Communication operations

- Services assisting mining operations

- Others: Supporting industry manufacturers, key mechanical products.

For further information please contact:

Tran Duong Nghia, Partner of Tax, Accounting and Consulting, ECOVIS AFA VIETNAM, Da Nang City, Vietnam

Email: nghia.tran@ecovis.com.vn

Contact us:

Nghia Duong Tran

ECOVIS AFA Vietnam

No. 142 Xo Viet Nghe Tinh StreetHoa Cuong Nam Ward, Hai Chau District

Danang City

Phone: +84 236 3633 333

www.ecovis.com/vietnam/audit