GST In Malaysia: Will It Return?

After spending a number of years studying Goods and Services Tax (GST), Malaysia was the last country in the Association of Southeast Asian Nations (ASEAN) excluding Brunei to implement GST in 2015. However, Malaysia became the first to abolish GST in 2018 after the fall of the Barisan Nasional government in the Malaysian 14th General Election. The purpose of introducing GST in Malaysia was to reduce fiscal deficit and debts of the government. Further, the tax revenue from oil had dropped drastically since 2014.

Since the abolishment of GST in 2018, the new Pakatan Harapan government has been finding ways to improve revenue collection, and at the same time repay the government debts. Examples of these initiatives are the new Sugar Tax (effective from 1 July 2019), the expansion of the scope of the Sales and Services Tax (which replaced the GST), and the latest Digital Services Tax effective from 1 January 2020.

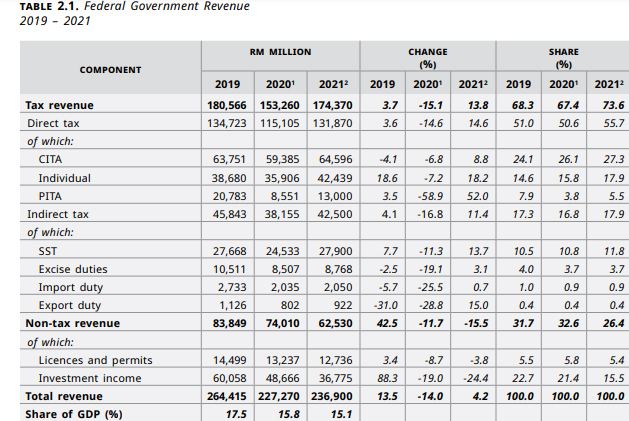

The voices calling to bring back GST have been louder recently, especially since the recent Budget 2021 under the new Perikatan Nasional (National Alliance) government. With reference to Table 2.1 in the 2021 Fiscal Outlook Report (see Figure 1), we can see the Malaysian government very much relied on direct taxes such as corporate income taxes, individual taxes and petroleum income taxes. The indirect taxes collected in 2019 and 2020 were only half of the total GST collected during the GST era.

Figure 1: 2021 Fiscal Outlook and Federal Government Revenue Estimates

Now, with various challenges ahead for Malaysia including political instability, stimulus packages provided by the government due to the pandemic, world oil prices, close to zero activity in the tourism sector, and economic turbulence caused by COVID-19, will there be a return of GST in Malaysia?