Modifications to the tax system in Paraguay

According to official data, Paraguay has a total population of 6,873,496 inhabitants. From this total, the total Economically Active Population (PEA) is 3,465,976, which corresponds to approximately 50% of the total population.

As of December 31, 2019, the total number of taxpayers registered with the Ministry of Finance was 824,179, which represents 24% of the total PEA. Likewise, in the portal of said ministry it is reported that the total collection of the year 2019, in preliminary figures is approximately 2,210 million US dollars.

A report issued by an economic study entity in Paraguay estimates that the informal economy in 2019 would be 16,522 million US dollars, which represents 40% of Paraguay’s GDP. Considering that the national Tax Pressure calculated for that same year was 9.9%, we can deduce that there is more than 1,635 million US dollars that do not enter the Paraguayan State.

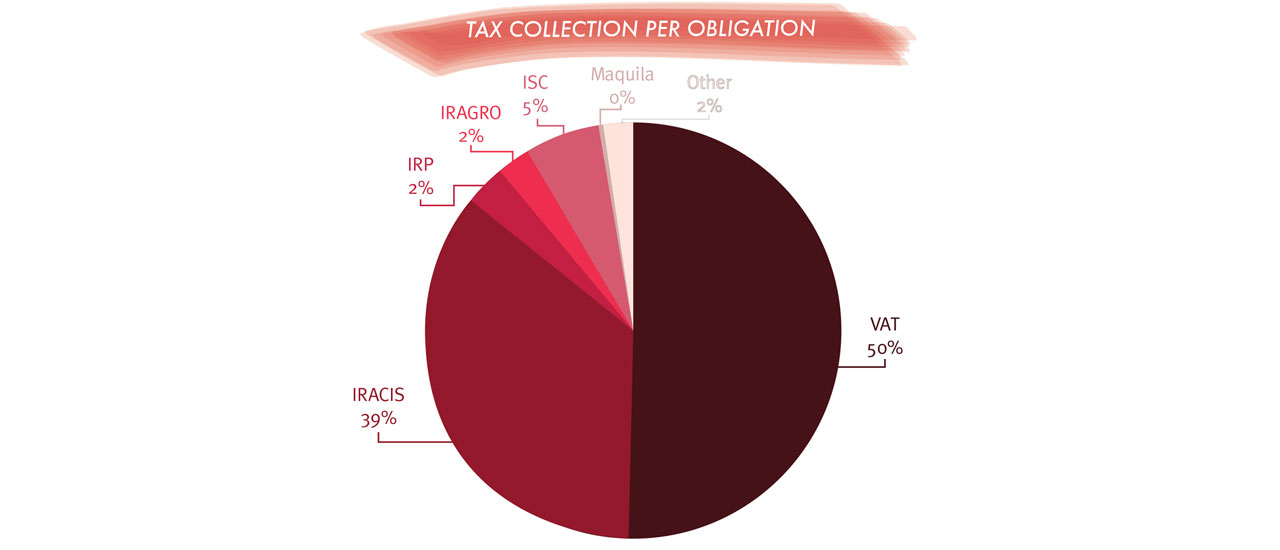

Regarding tax collection, 55% of everything collected in 2019 comes from Value Added Tax (50%) and Selective Consumption Tax (5%), which are considered indirect taxes; 41% comes from corporate income taxes and only 2% corresponds to personal income tax.

Within this context and with the objective of simplifying the Paraguayan tax system and democratizing the payment of taxes, the National Government has implemented the Law 6380/2019 of “Modernization and Tax Simplification” which seeks that those who earn more, pay more.

After 27 years, the national tax system has been modified to adapt to international standards in the area of tax management. For example, it has been implemented a Non-Resident Tax which did not previously exist. In addition, the modification has created a simplified system as various income tax obligations have been unified, creating simpler categories to manage. These changes are aimed at the micro and small business sector, granting these entities to leave the informal economy and begin to operate formally, allowing this to have a record of operations to access better commercial and financing conditions.

The taxes in force as of this new law are the following:

- Selective Consumption Tax: with rates from 11% to 50% to be applied to specific products such as tobacco, cigarettes, essences, beverages, products with high caloric content, fuels and other goods. This is a tax that was already in force which taxes the importation of these goods as well as the first alienation to any title, when they are of national production.

- Non-Resident Income Tax: with a 15% rate on the net income obtained in operations carried out in Paraguay by natural and legal persons not resident in the Country. Although the previous legislation existed, now the obligation is to practice withholdings of VAT and on Income to the payment of services contracted abroad by persons and Paraguayan companies. This is a new tax system which enters into force and develops in more detail the parameters of the tax, configured as a duly individualized income tax that the taxpayer of foreign jurisdictions with whom the country has signed agreements with, in order to avoid double taxation, can deduct from the income tax to be paid in his country.

- Tax on Dividends and Utilities: this tax levies dividends or returns made available or paid to the owner, consortiates, partners or shareholders by the company. Previously, there was only the figure of the withholding of an additional income tax of 5% that the company should make to its shareholder and this on its side should pay, in case of being reached by the Tax to Personal Income another 5% on the amount credited or paid. In this way the total received by the Tax Administration was 10% on profits. The new Law establishes a rate of 8% for natural or legal persons resident in the country and 15% for non-residents in Paraguay.

- Value Added Tax: with a rate of 5% and 10% depending on the type of product and service marketed. This is a current tax in which some minor modifications are added, such as the elimination of simplified semi-annual submission regimes, becoming monthly for all cases.

- Business Income Tax: with a 10% rate on corporate profits. This tax unifies the previously existing ones that were divided into Income Tax for Commercial, Industrial and Service Activities (IRACIS); the Income Tax for Agricultural Activities (IRAGRO) and the Income Tax for Small Taxpayers (IRPC). For this tax, two differentiated regimes of less complexity are established, aimed at small establishments and microentrepreneurs, the SIMPLE and RESIMPLE regime, which will be applied according to the turnover level of the companies.

- Personal Income Tax: with progressive rates of 8% to 10% depending on the level of taxpayer income. Thus, those taxpayers who obtain an annual income of up to PYG 50 million (USD 8,000 approx) per year, will pay 8%, up to PYG 150 million (USD 24,000 approx), will pay 9% and those who have a higher income will pay 10% tax.

While this Law is in the process of being implemented, it is expected to be enforced as of this year. Regarding tax pressure, although in some specific terms some calculation bases are modified and new tax figures are incorporated, the essence of the Law seeks to broaden the tax base, rather than increase taxes.

In addition, the tax laws that favor Foreign Investment such as the Maquila Law, the Incentives Law for National and Foreign Investment, the Law for Incentives for the Production, Development or Assembly of High Technology Goods, among others, are still in force.

With the application of this new Tax Reform, Paraguay aims to promote the formalization of the economy and the adaptation of fiscal dynamics to the international fiscal management standards, which should attract foreign investors.