India Adopts Faceless Tax Assessments and Appeals: A Pragmatic Approach

Background

One impact of the global Coronavirus pandemic is that, in some parts of the world, the use of digital communications has accelerated. India has adopted “faceless” interactions through digital means with tax payers, and the Revenue department has been agile in keeping up with changes, introducing faceless tax assessments and appeal schemes for all categories of taxpayers (barring a few exceptions) across the country.

The Faceless Assessment Scheme will revolutionise the way in which the scrutiny of tax return assessments are conducted and will fully digitise the interactions between taxpayers and the Revenue. The scheme has been introduced with the intention of making entire direct tax administration ‘seamless’, ‘painless’, and ‘faceless’. It will eliminate the physical interface between the taxpayers and the Revenue so as to impart greater efficiency, transparency and accountability.

In this scheme the taxpayer does not know the identity of the assessing officer who conducts his scrutiny assessment and the focus has shifted to team-based working and functional specialisation without any human interface. Thus, the era of visiting the tax office to personally meet the jurisdictional assessing officer is now history.

Similar to the Faceless Assessment Scheme, the Government launched the Faceless Appeal Scheme, 2020. As the name suggests, the Faceless Appeal Scheme, 2020 is aimed at eliminating physical (ie face-to-face) contact between the taxpayer and the first appellate authority [Commissioner of Income-tax (Appeals) level]. The architecture and the framework of both these schemes is largely similar and will be detailed throughout this article.

Framework

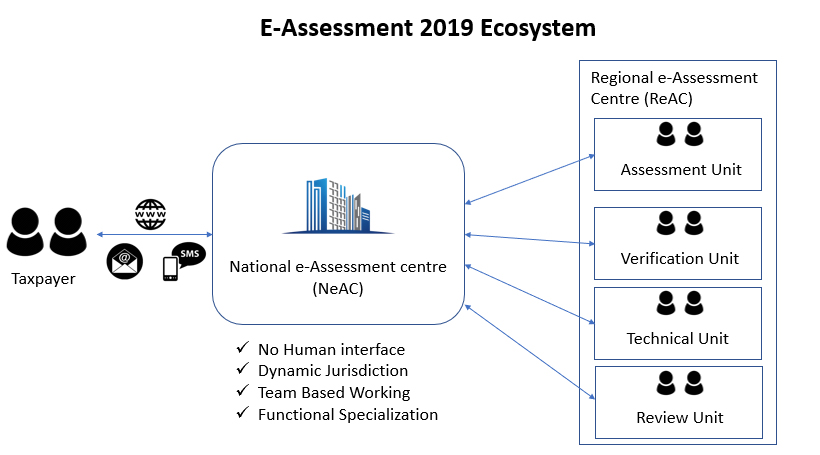

For the purpose of faceless assessment, the Central Board of Direct Taxes (CBDT) which is a governing body would set up the below ‘centres’ and ‘units’, and specify their respective jurisdiction:

- A ‘National e-Assessment Center’ for facilitating e-assessment and central control.

- ‘Regional e-Assessment Centers’ under the jurisdiction of the regional Principal Chief Commissioner to conduct assessment.

- Assessment units for identifying points or issues, materials for determining any liability (including refunds), analysis of information, and other such functions.

- Technical support including legal, accounting, forensic, information technology, valuation, auditing, transfer pricing, data analytics, management or any assistance or advice on any other technical matter for technical units.

- ‘Verification units’ for enquiry, cross verification, examination of books of accounts, witness and recording of statements, and such other functions.

- ‘Review units’ for reviewing the draft assessment order to check whether the facts, relevant evidence and law and judicial decisions have been considered in the draft order.

- All communications between all the above units will be through the National e-Assessment Center for the purpose of evaluation under this scheme.

Assessment

The Income Tax Department not only reviews the Income Tax Return (ITR) filed by taxpayers, but also monitors their ITR filing pattern. Based on this, the department selects a few cases for a detailed examination, known as Randomly Raised Cases. This process of detailed investigation of the affected ITR is called income tax investigation. Under Section 143 (2) of the Income Tax Act, an income tax notice is sent to such taxpayers to advise that their ITR has been raised for investigation.

Procedure

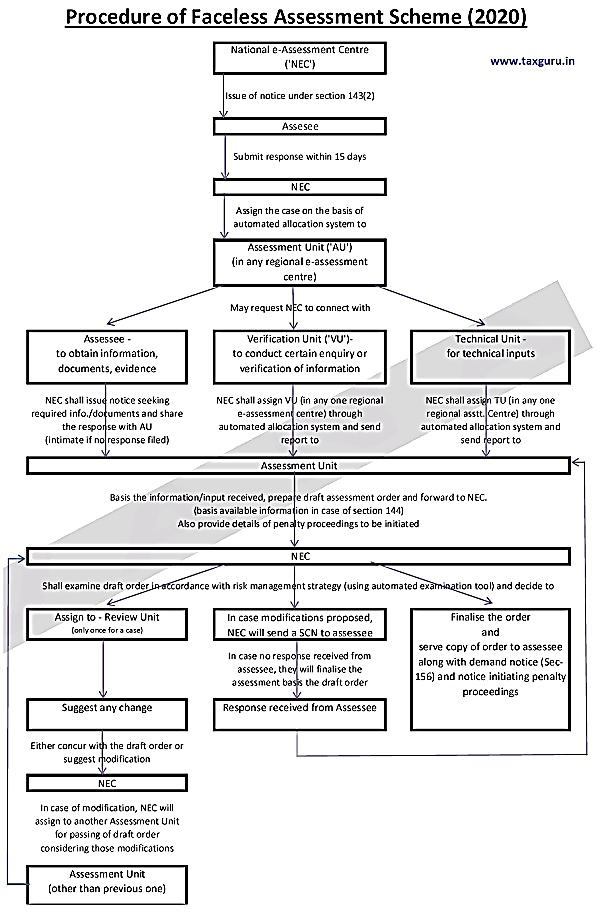

The procedure for e-assessment is as below:

- The National e-Assessment Centre will issue notice under section 143(2) online by uploading the digitally signed copy on the registered income tax account or by sending notice to the assessee’s registered email address or uploading the copy on a mobile app. A real time alert will be sent through SMS or the mobile app.

- The taxpayer has a period of fifteen days to file a response with the NEC.

- The taxpayer’s case is assessed via e-assessment only when the taxpayer voluntarily fails to submit the income tax return, or the taxpayer is asked to submit the return in response to the notice.

- The NEC will assign the selected case for the purposes of e-assessment to a specific ‘assessment unit’ in one of the ‘Regional e-Assessment Centers’ via an automated allocation system.

- Once the case has been submitted to an assessment unit, the unit can request from the NEC an assessment will include assessment under section 143(3) and under section 144.

Scrutiny assessment

a) Obtaining such further information, documents or evidence from the taxpayer or any other person, as it may specify

b) Conducting of a certain enquiry or verification by verification unit; and

c) Seeking technical assistance from the technical unit

- Upon request being made by the assessing unit for any document or evidence, the NEC will issue appropriate notice or requirement to the taxpayer, or any other person, to obtain the information, documents or evidence required by the Information Unit.

- The taxpayer can submit a response to the notice within the time specified in the notice.

- When requested for investigation or verification as above, the request will be submitted by the NEC to the verification unit via an automated allocation system.

- A technical unit will be assigned to the regional e-assessment centres via an automated allocation system by the NEC, following a request for technical assistance.

- The NEC will send the report received from the verification unit or technical unit to the concerned assessment unit.

- If the taxpayer fails to file a reply to the notice, the National E-Valuation Center will issue a notice to make a best judgment assessment.

- The taxpayer can file a response to the notice issued. However, if the taxpayer does not file a response, the national e-assessment will inform the assessment unit, which in turn will prepare a draft assessment order under the best judicial assessment.

- The assessing unit shall take into account all the above related materials, pass a draft assessment order, either accept the taxpayer’s returned income or may modify the taxpayer’s returned income, as the case may be, and send such order.

- The Order Evaluation Unit provides details of penalty proceedings to be initiated when making a draft evaluation order, if required.

- The NEC will examine the draft assessment order in accordance with the risk management strategy specified by the CBDT through an automated examination tool, under which it can decide to:

A) Finalize the assessment in accordance with the order of assessment and to initiate punitive proceedings on the taxpayer, if required, with demand notice, specifying the amount due, or withdrawal for any reason. It may also serve a copy of the notice to the taxpayer on the basis of such assessment; or

B) provide an opportunity to the taxpayer; if the amendment is proposed, the assessment should not be completed as per the order to show cause, by sending notice to give notice; or

C) For organized review of such order, assign the draft assessment order to the review unit through any one of the regional e-assessment centres.

D) The review unit shall conduct review of the draft assessment order, referred to it by the NEC, whereupon it may decide to:

Compute the draft assessment order and inform the NEC about such consent; or

Suggest such amendments, as may fit into the draft assessment order, and send suggestions to the NEC.

Powers

The Principal Chief Commissioner or the Principal Director General, National E-Assessment Center, in charge of the National E-Assessment Center, shall set standards, procedures and process for the effective functioning of regional e-Assessment Centers. Units have been set up under this scheme. The system will operate in an automated and mechanized environment, including format, mode, process and processes with respect to the following, namely:

- Service of notice, order or any other communication;

- Receipt of any information or documents from a person in response to a notice, order or any other communication;

- Issuing acknowledgment of the response submitted by the person;

- Provision of e-action facility, including account login facility, status of assessment, displaying relevant details and download facility;

- Verification Accessing, and authentication of information and feedback, including documents submitted during the evaluation period;

- The receipt, storage and retrieval of information or documents in a centralized manner;

- General Administration and Grievance Redress Mechanism in the respective centres and units.

- Circumstances to approve an individual hearing.

Conclusion

With the introduction of faceless assessments and appeals, the process of the taxpayer resolving doubts and holding discussions with Revenue Officers will now have to be substituted by extensive and time-bound written submissions. In addition, the ability to make it easier for the assessing / reviewing authority to comprehend important aspects of the submissions, and the need for robust paperwork, will now be more important than ever. The eloquence that taxpayers have demonstrated when representing their case in person will now have to be demonstrated on paper. I would suggest that there is definitely a need for taxpayers to make finer and significant changes in the entire approach towards scrutiny assessments and appeals, and several processes will become extremely crucial going forward.

(The author is Chairman Emeritus of Ecovis-RKCA Advisors Ltd in India)