Financial reform for technology-oriented SMEs

As of 1st January, 2018, high-tech enterprises, technology-oriented small- and medium-sized enterprises (SME) and small low-profit enterprises are entitled to further tax relief. According to the Chinese ministry of finance, two major measures have been implemented since January this year.

Policy

First, a high-tech enterprise or a technology-oriented SME may, in the year it complies with the conditions, carry forward the losses incurred in the preceding five years to the extent of the portion that has not been offset yet, for up to ten years in the future. This marks an increase of five years.

Second, during the period from January 1, 2018, to December 31, 2020, the previous CNY 500,000 upper limit of the annual taxable income of a small low-profit enterprise is doubled to CNY 1 million.

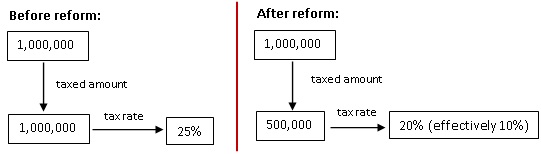

In practice this means that if the annual taxable income of a small low-profit enterprise is equal to or lower than CNY 1 million, its tax payable will be calculated based on 50% of the taxable income. In addition, the tax rate is reduced from 25% to 20%, resulting in an effective final income tax rate of only 10% of the taxable income. The following graph illustrates this matter more clearly.

Criteria

Nevertheless, there are certain criteria which companies have to meet to be eligible for the benefits mentioned under the second point.

- 1. To be eligible, enterprises should not be engaged in industries restricted or prohibited by the Chinese Government and they should meet the conditions described below.

- 2. Conditions

- 2.1 Labour-oriented companies: annual income tax shall not exceed 1 million RMB; assets of the company shall not exceed 30 million RMB; the company shall not employ more than 100 workers. (The number of workers includes leased workers as well as workers employed by the company.)

- 2.2 Other companies: annual income tax shall not exceed 1 million RMB; assets of the company shall not exceed 10 million RMB; the company shall not employ more than 80 workers.

In introducing tax breaks also designed to apply to smaller technology-oriented businesses, China is trying to make them independent of foreign know-how. We can tell you what effects this tax relief has on SMEs.

In introducing tax breaks also designed to apply to smaller technology-oriented businesses, China is trying to make them independent of foreign know-how. We can tell you what effects this tax relief has on SMEs.

Conclusion

This financial reform further facilitates China’s agenda to strengthen its high-tech industry and to decrease China’s dependence on foreign technologies. To achieve this, China is not only focusing on large scale tech-companies but also on smaller ones by easing the financial pressure and giving them further incentives to concentrate on gaining profits. ECOVIS Beijing understands what advantages and disadvantages these changes bring to enterprises operating in China. Our tax team provides clients with tailored concepts keeping in mind reforms and policy changes.

Contact us:

Richard Hoffmann

ECOVIS European China desk

Lenaustrasse 1269115 Heidelberg

Phone: +49 6221 9985 639

www.ecovis.com/heidelberg