Corona Pandemic: Immediate Taxation, Legal Measures and Financial Aid in Italy, Law Decree No. 23

Italy has unfortunately been the European country worst affected by coronavirus so far. To reduce the impacts on businesses caused by COVID-19, the Italian government released Law Decree No. 23 on Liquidity on 8 April 2020. The Ecovis professionals in Italy summarise for you.

“Liquidity Decree” Approved

On 8 April 2020, urgent measures were announced to sustain business liquidity and exports. This decree is subsequent and supplementary to the previously released “Cura Italia” and contains new economic measures and urgent provisions to deal with the COVID-19 emergency, in particular in the following four areas.

1. Measures to sustain business liquidity

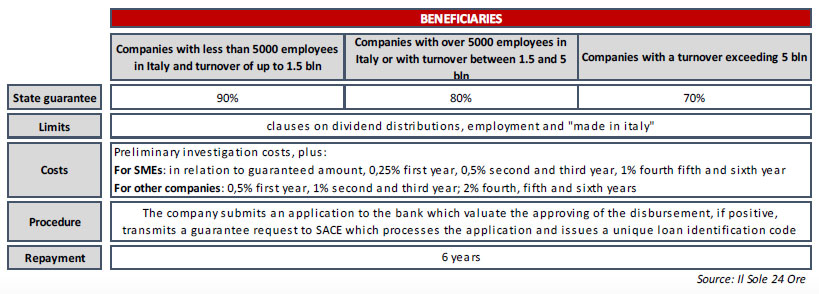

- Temporary measures to sustain business liquidity: The provision of a EUR 200 billion guarantee to authorised lenders in Italy (banks, financial institutions etc.) until 31 December 2020.

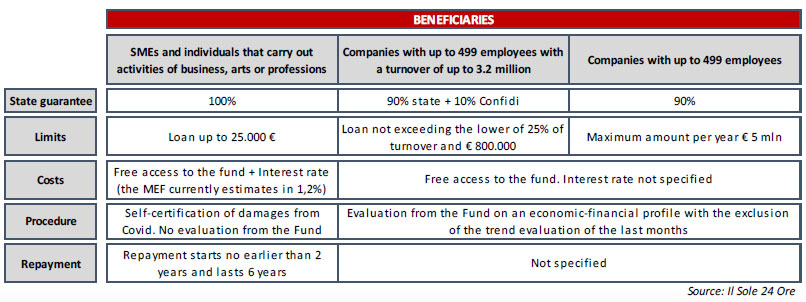

- Central guarantee fund for SMEs: The purpose is to facilitate access to financing for small and medium-sized enterprises (SMEs) by granting a state guarantee to replace and/or increase those provided by companies.

2. Tax interventions

- Suspension of tax payments and social security contributions: Taxpayers with revenue less than EUR 50 million, who have recorded a decrease in turnover and fees of at least 33% in March and April 2020 compared to the same months of the previous tax period, are allowed to suspend payments of withholding taxes on employees, VAT, social security contributions and mandatory insurance premiums expiring in April and May 2020. Suspended payments must be made by 30 June 2020 in a lump sum, or in a maximum of 5 equal monthly instalments.

- Option to suspend tax obligations and payments: Remunerations paid to taxpayers with turnover less than EUR 400,000 in 2019 are not subject to withholding taxes in the period between 8 April and 31 May 2020. The withholding taxes shall be paid in a single payment by 31 July 2020 or in up to 5 equal monthly instalments from July 2020.

- Suspension of deadlines for certain payments: For all taxpayers, tax payments and payments to public administrations, including social security contributions and mandatory insurance premiums are deemed regularly carried out if made by 16 April 2020.

- The deadline for the delivery and electronic filing of CU2020 is extended to 30 April 2020. Penalties for late filing are not applicable before 30 April 2020.

- Taxpayers running a business or practicing a professional activity may benefit from a tax credit equal to 50% of the expenses incurred in 2020 for sanitising their workplace, as well as for the purchase of personal protective equipment and other safety devices. All taxpayers can apply for the tax credit, provided that the expenses do not exceed EUR 20,000.

3. Business continuity guarantee

- Temporary provisions on capital reduction are not applied until 31 December 2020.

- Financial statement standards: In preparing the financial statements in progress at 31 December 2020, the valuation of items in the perspective of business continuity can still be applied if it exists in the last financial statement closed prior to 23 February 2020. The evaluation criterion is specifically illustrated in the explanatory notes. The provisions also apply to financial statements closed by 23 February 2020 and not yet approved.

- Temporary provisions on company financing: Loans granted to companies by shareholders or by those carrying out management and coordination activity in companies will not be subordinated to the satisfaction of other creditors. This only applies to loans made from the date of the Decree until 31 December 2020.

4. Further provisions

- All civil, criminal, tax and military justice hearings are postponed until 11 May 2020.

Travel and immigration

- Residence permits: All permits for stays in Italy expiring between 23 February and 16 April 2020 are automatically extended to 15 June 2020.

- The following rules on travel have been valid and mandatory from 28 March 2020:

- Before boarding, self-certification must be provided showing the reason for travel, the place of self-isolation, means of transportation and a contact phone number.

- Travellers entering Italy by plane, ferry or train must avoid using public transport after arrival. Scheduled pick-up is requested.

All persons entering Italy are requested to self-isolate. People entering Italy for work may postpone the start of self-isolation by 72 hours. - All persons entering Italy must report to the health authorities at their destination.

- A civil protection service is provided to those travellers who cannot arrange self-isolation.

- The measures do not apply to cross-border workers, health service personnel and passenger/freight transport crews

- Travellers in transit must provide proof of the necessity to travel, as well as proof of not leaving the airport.

- Nationals and foreign residents in Italy, who are abroad temporarily, are allowed to return to Italy.

Ecovis Italy has exclusively prepared a complete information tool for its clients and is ready to provide support for any specific professional questions. Please contact us directly for support with all the detailed information of the new Law Decree. Ecovis Italy is here to help our clients find the most efficient solutions to survive through this difficult time.