ECOVIS Corporate Finance CZ advises on minority stake sale

ECOVIS Corporate Finance CZ advised the owners of ALFA 3, a leading Czech manufacturer of industrial metal furniture and smart storage systems, on the sale of a minority stake to the BHS Private Equity Fund. Jan Slabý and Lubomír Dugovič, partners at ECOVIS Corporate Finance CZ, led the transaction process on the sellers’ side.

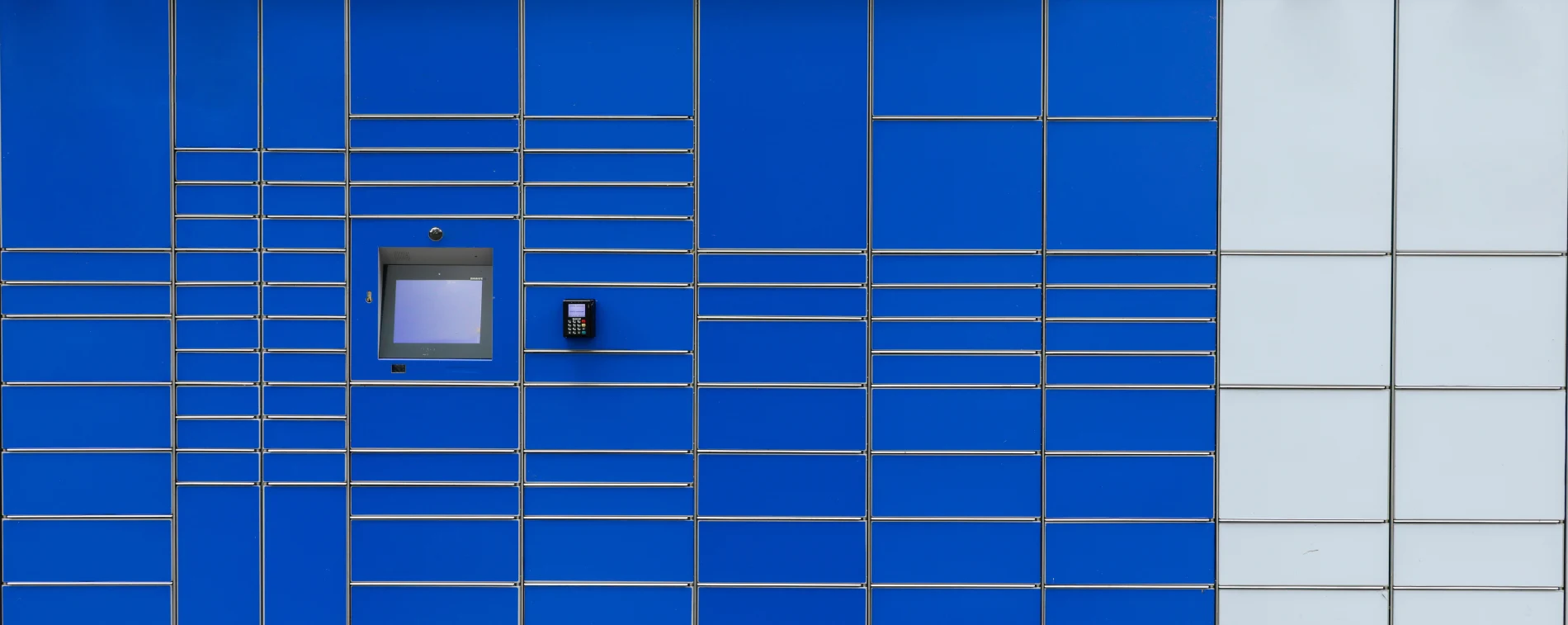

ALFA 3, s.r.o. has spent nearly 25 years building a strong market position as a designer, manufacturer and supplier of modern storage solutions for use in e-commerce, logistics, offices and industrial environments. The company also produces metal furniture, including lockers and workshop cabinets, as well as charging cabinets for e-bikes and electronic devices. The business is owned by four co-owners who will remain shareholders and members of the management team, ensuring continuity of strategy and know-how.

The entry of BHS Private Equity Fund marks an important step in the implementation of ALFA 3’s long-term growth strategy, which focuses on further expansion in the Czech market and abroad. The company aims to strengthen its position as a recognised European leader that combines quality, innovation and design with a sustainability-driven approach. BHS Private Equity Fund, which is managed by Versute Investments a.s., focuses on investing in small and medium-sized enterprises operating in traditional sectors of the economy in the Czech Republic and Slovakia, supporting their transformation and further growth in value.