Independent Business Review

Are you too close to your business? Do you need fresh perspective?

There is a famous saying that “familiarity breeds contempt.” Pretty strong statement but often true. Companies can get into a situation where they simply do things in the same way with the same people because this is the way they have always done it. It can sometimes take a major event such as COVID to force managers and owners to really think about whether the way they work is still in the best interests of the company. However instead of waiting for a calamity like COVID to force management teams into change on an unplanned basis the alternative is to have an Independent Business Review every few years to get new views and ideas.

What is an Independent Business Review (IBR)?

An IBR is a full examination of all aspects of a business carried out by a suitably qualified and experienced accounting professional. The best reviews are normally carried out by professionals who have Big 4 type practice experience but who can also demonstrate a track record of actual CFO work in industry and business turnaround expertise. This combination of experience will ensure that this review does not simply become a procedural, compliance exercise (that the auditors should really be covering) but a real insight into how the company makes money and how it can make more.

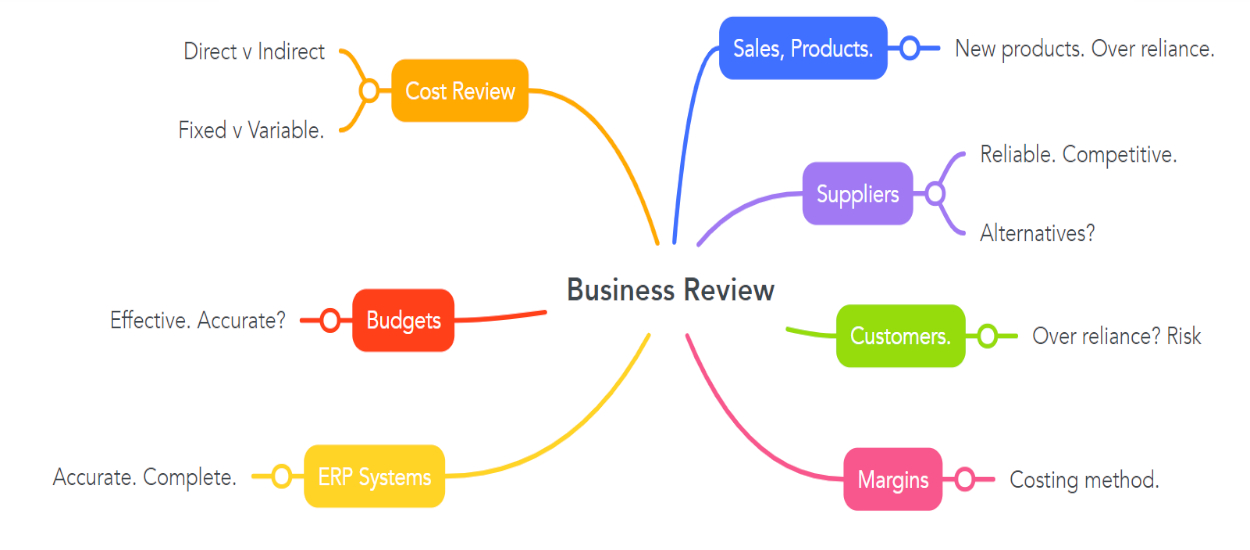

Some Key Elements of the Review.

Overall Industry KPI’s

How does this company’s results compare to their competitors and the industry in general?

Sales and Margins.

What are the key products and detailed analysis of gross margin? How does the gross margin compare with other companies?

Are we over reliant on one or two products? Do we have new products coming online?

Are we getting the best deal out of our key suppliers?

For manufacturers what is our true capacity? Do we have spare capacity that we can use to sell cheaper products?

How are we allocating overheads? Big question of marginal overhead allocation versus total overheads where total allocation becomes confusing when capacity or volume changes on a regular basis.

Cost Structure Analysis.

Do we have a clear definition and clarity about what is direct cost and included in margin calculation and what is indirect cost and not in margin calculation?

Are all our indirect costs necessary and are there outsourcing alternatives?

Can any jobs currently carried out by indirect staff be transferred to direct staff. With a decent ERP system, it may be possible to have delivery men doing billings. Just look at Amazon.

Basic Outline

This is a very brief outline. Please call me if you want to discuss in detail. If any of the topics are unfamiliar I recommend you call me as a matter of urgency.